Part 5: CONVERGENCE · Chapter 12

The Great Agi Race: Strategic Bitcoin Reserve as Civilizational Infrastructure

Beyond Computational Supremacy

This chapter examines the Strategic Bitcoin Reserve (SBR) through a novel analytical lens: its role as infrastructure for artificial general intelligence competition. Building on the thermodynamic security principles established in Chapters 3 and 10, we argue that monetary sovereignty provides the foundation for the institutional characteristics—trust, information quality, data variety, and long-term orientation—that determine success in developing beneficial AGI.

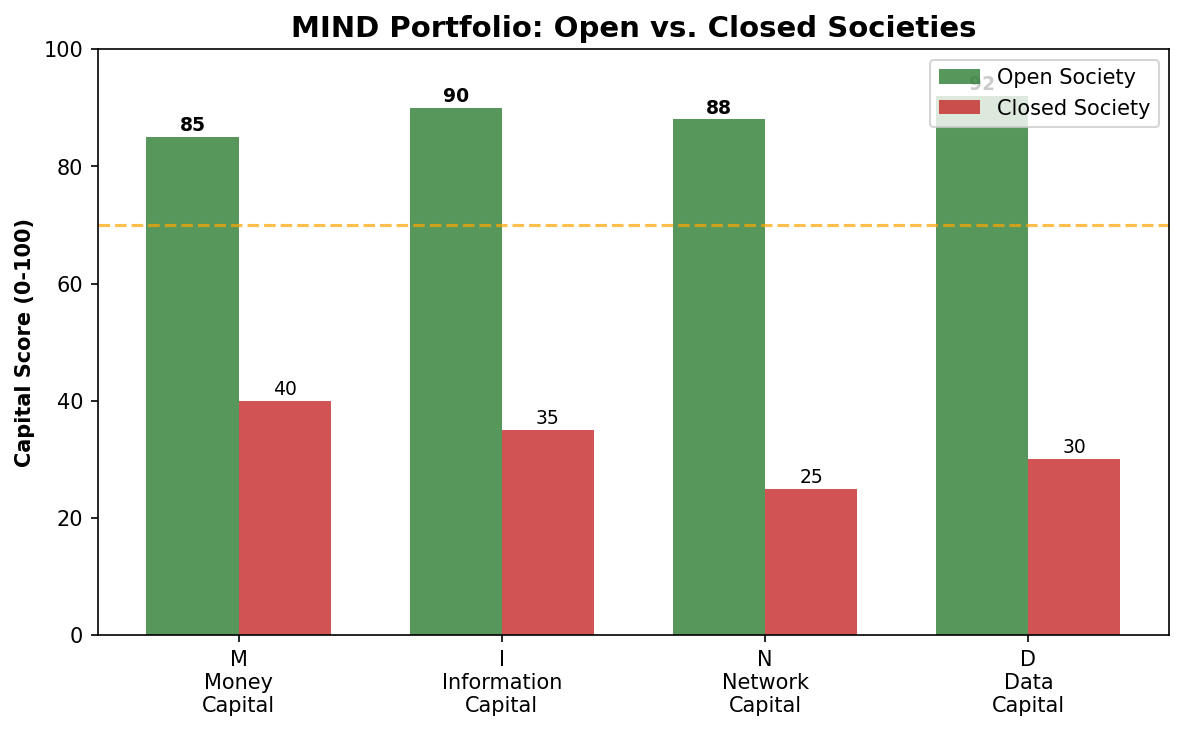

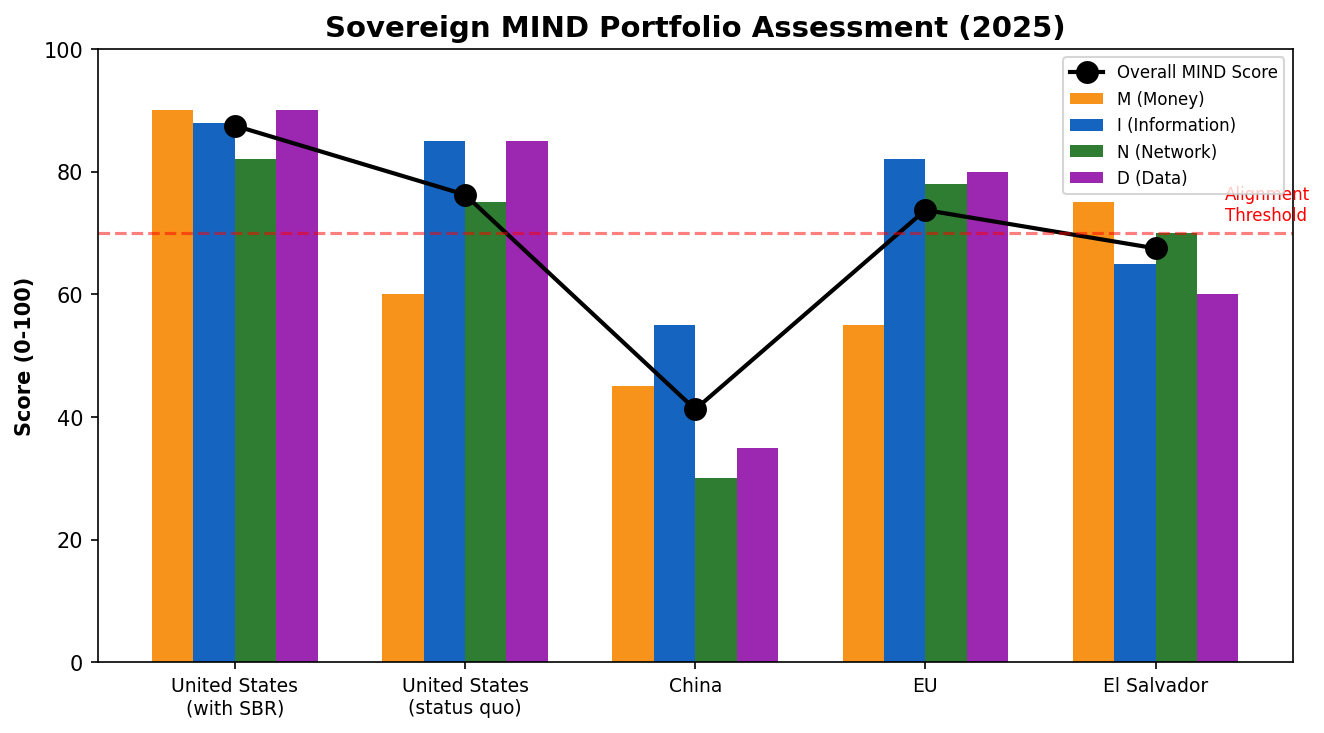

The conventional framing of the 'AGI race' focuses almost exclusively on hardware metrics: GPU stockpiles, chip fabrication capabilities, and training compute. This chapter challenges that framing by introducing a complementary analytical framework—what we term the MIND portfolio—that identifies four distinct capital types essential for beneficial AGI development. We argue that the Strategic Bitcoin Reserve strengthens all four components, positioning adopting nations for sustainable advantage in the most consequential technological competition in human history.

The chapter proceeds as follows: Section 12.2 presents the MIND portfolio framework. Section 12.3 analyzes why authoritarian systems face structural disadvantages in AGI development. Section 12.4 examines monetary capital as the foundation of the MIND portfolio. Section 12.5 develops the Strategic Bitcoin Reserve as AGI infrastructure. Section 12.6 presents game-theoretic analysis of sovereign positioning. Section 12.7 connects the analysis to the AI alignment problem. Section 12.8 traces the trajectory from strategic reserve to civilizational resilience. Section 12.9 concludes.

The Mind Portfolio Framework

The conventional wisdom about artificial intelligence competition focuses almost exclusively on hardware metrics. Nations stockpile graphics processing units, compete for advanced chip fabrication capabilities, and measure progress in teraflops and training runs. China's explicit goal of AI supremacy by 2030, backed by massive state investment and centralized coordination, embodies this logic. The underlying assumption: whoever assembles the largest computing clusters will achieve superintelligence first and reap insurmountable advantages.[12.1]

Emad Mostaque, founder of Stability AI and architect of the open-source AI movement, offers a radically different perspective. His analysis suggests that computational resources represent necessary but insufficient conditions for AGI development. Drawing on Mostaque's insights, we propose the 'MIND portfolio' framework—a constellation of capital types that determine a society's capacity for innovation, adaptation, and ultimately, alignment with human values.[12.2]

The Mind Framework Defined

The MIND framework identifies four distinct but interconnected forms of capital essential for beneficial AGI development:

Capital | Definition | AGI Relevance |

M - Money | Monetary system integrity; price signal reliability | Enables long-term R&D investment, accurate resource allocation, low time preference essential for alignment research |

I - Information | Quality and free flow of knowledge | Training data quality, scientific knowledge accumulation, rapid error correction through open debate |

N - Network | Social trust and cooperation capacity | Cross-institutional collaboration, talent attraction/retention, honest failure reporting for safety research |

D - Data | Variety, depth, and diversity of inputs | Training diversity for robustness, edge case coverage, viewpoint variety for value alignment |

Table 12.1: The Mind Portfolio Framework for Agi Competition.

The critical insight is that these capital types exhibit strong complementarities and cannot be maximized independently. A society that degrades its monetary system (M) undermines the trust networks (N) necessary for collaboration. A regime that restricts information flow (I) necessarily limits the data variety (D) available for training. Most importantly, a system that sacrifices any MIND component for short-term computational gains may win battles but will lose the war.[12.3]

Why Authoritarian Systems Face Structural Disadvantages

The intuition that closed, authoritarian systems should dominate the AGI race appears compelling. Such systems can direct unlimited resources toward strategic priorities, avoid democratic deliberation inefficiencies, suppress competing uses of talent and capital, and maintain secrecy about progress. Yet the MIND framework reveals why this intuition is fundamentally flawed.[12.4]

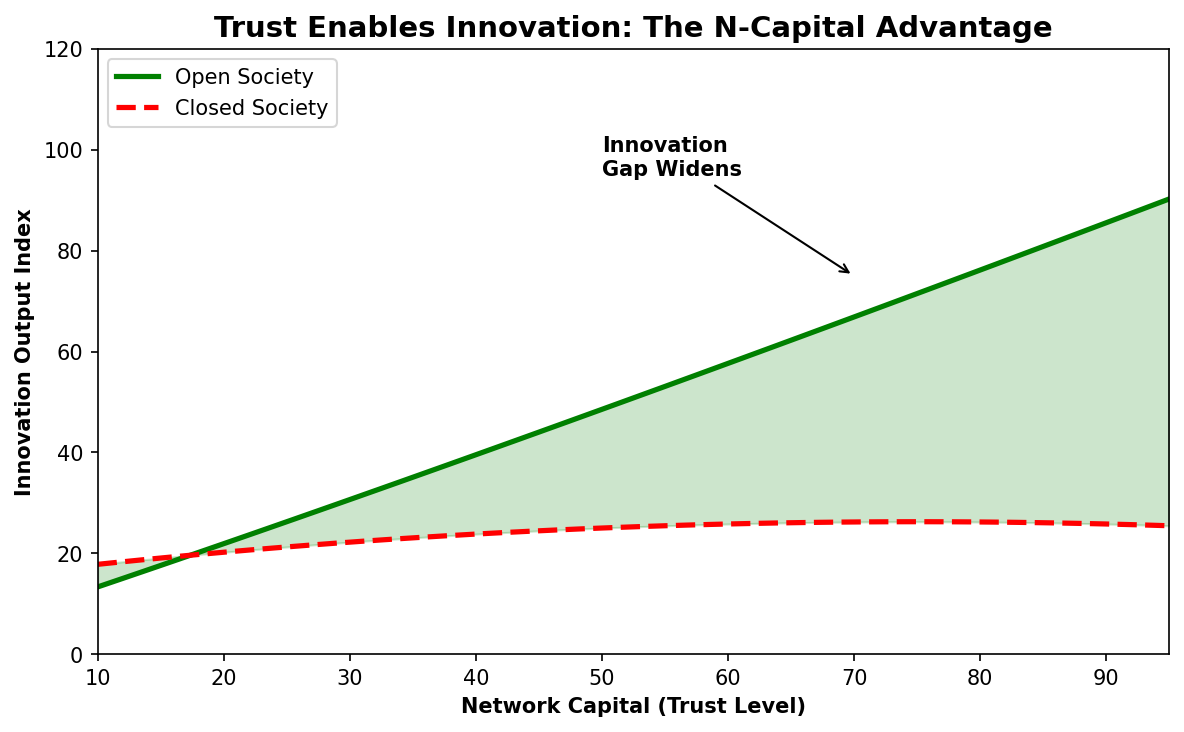

The Trust Deficit (N-Capital Collapse)

Network capital depends on voluntary cooperation, honest communication, and reasonable expectations that agreements will be honored. Authoritarian systems systematically destroy these conditions. Scientists fear sharing preliminary findings that might contradict official narratives. Engineers avoid reporting failures that could trigger political consequences. International collaboration withers as external partners cannot trust information flows or intellectual property protections.[12.5]

The consequences for AI development are profound. Alignment research—ensuring advanced AI systems remain beneficial—fundamentally requires high-trust collaboration across diverse perspectives. Researchers must openly share failure modes, honestly assess risks, and collaboratively develop safety measures. These activities are structurally difficult in low-trust environments where information sharing carries political risk.[12.6]

The Variety Deficit (D-Capital Atrophy)

Data capital refers not merely to data quantity but to its variety, depth, and representativeness. Authoritarian systems systematically homogenize their information environments. Censorship eliminates viewpoints deemed unacceptable. Self-censorship suppresses exploration of sensitive topics. The result is training data reflecting official positions rather than reality's full complexity.[12.7]

For AGI development, this variety deficit creates critical blind spots. Systems trained on homogenized data perform poorly on edge cases, fail to anticipate diverse user needs, and embed biases from constrained training environments. More fundamentally, alignment with human values requires exposure to the full range of human perspectives—precisely what authoritarian systems cannot provide.[12.8]

MIND Component | Open Society Advantage | Authoritarian Deficit |

Money (M) | Price signals enable efficient allocation; low inflation preserves time preference | Capital controls distort signals; monetary manipulation raises time preference |

Information (I) | Free flow enables rapid iteration; scientific consensus from open debate | Censorship delays error correction; official narratives override empirical findings |

Network (N) | High trust enables collaboration; talent attracted by freedom | Surveillance destroys trust; talent flees or self-censors |

Data (D) | Diverse viewpoints captured; edge cases represented | Homogenized perspectives; systematic blind spots |

Table 12.2: Structural Mind Portfolio Comparison—Open vs. Authoritarian Systems.

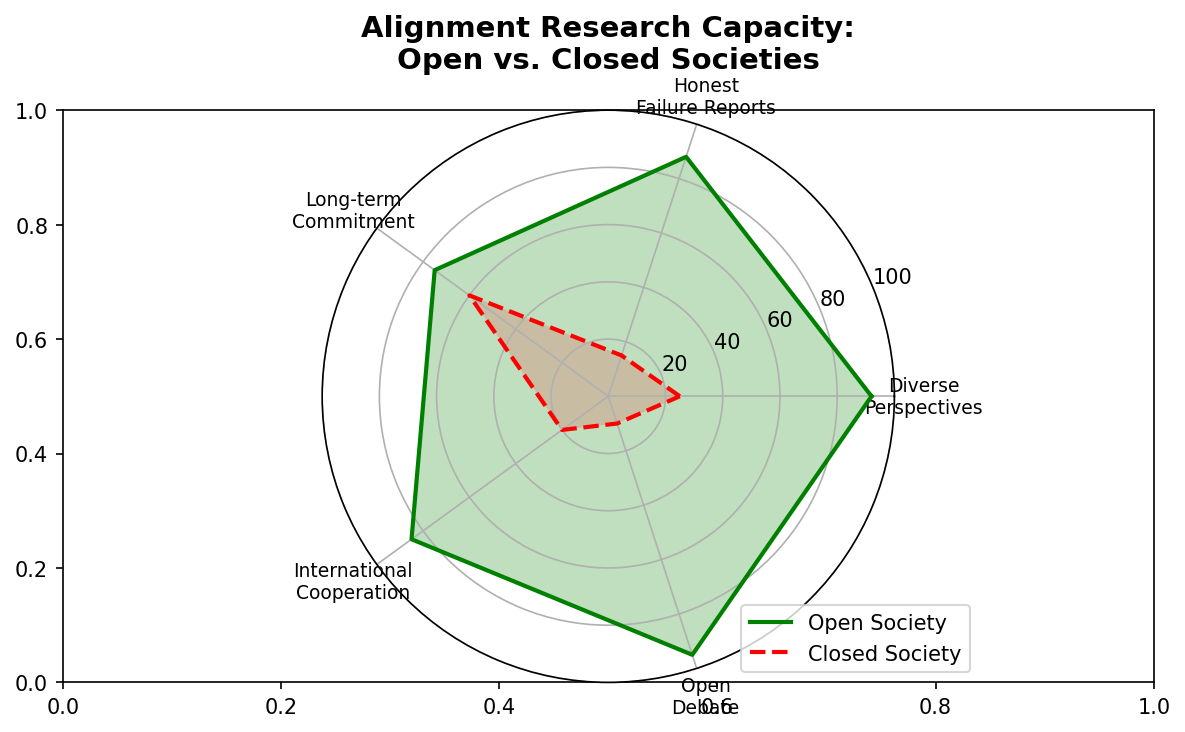

The Alignment Challenge

The ultimate test of the MIND framework comes in the alignment problem—ensuring superintelligent systems remain beneficial to humanity. This challenge is not merely technical but fundamentally social. Successful alignment requires several interconnected capabilities:[12.9]

First, defining human values presupposes mechanisms to aggregate diverse preferences across billions of humans with conflicting interests. Second, testing systems against the full range of human concerns presupposes data variety. Third, honest reporting of failure modes presupposes trust networks. Fourth, long-term thinking about civilizational consequences presupposes monetary stability enabling low time preference.

Authoritarian systems struggle on every dimension. They cannot honestly aggregate preferences because dissent is suppressed. They cannot test against full variety because variety has been eliminated. They cannot support honest failure reporting because failure carries political consequences. A nation achieving AGI first under these conditions may create something powerful, but is unlikely to create something aligned with genuine human flourishing.[12.10]

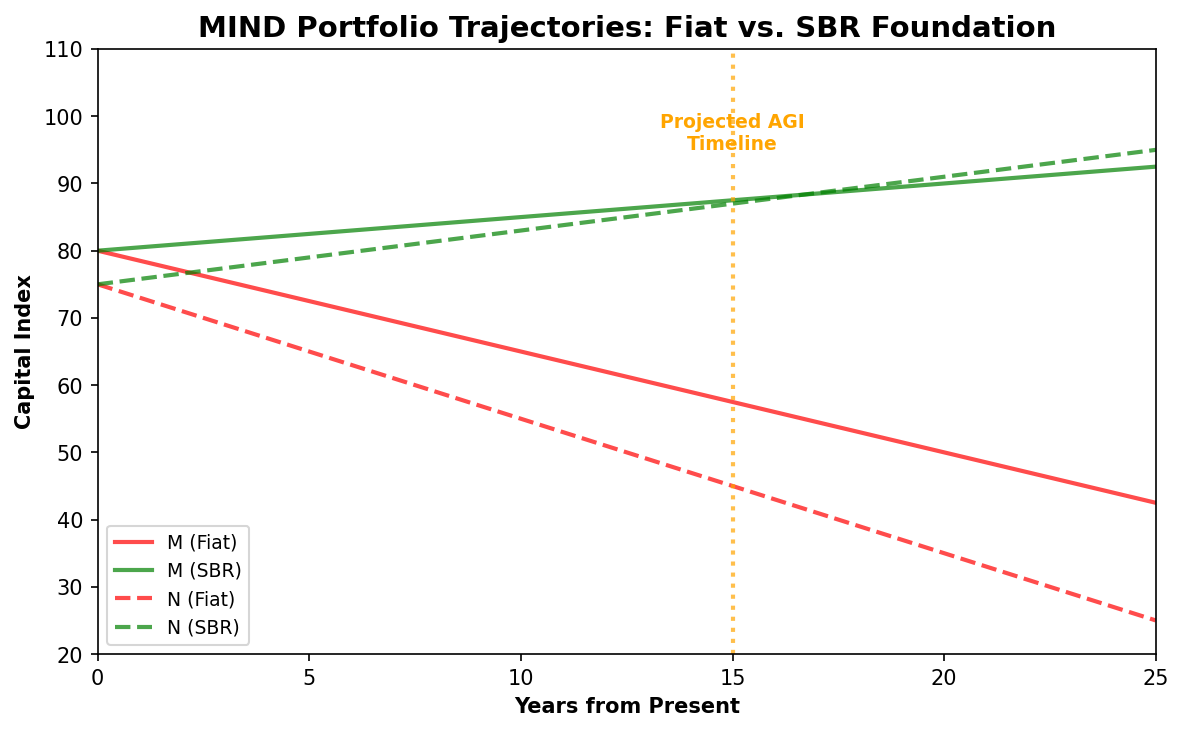

Money Capital: The Foundation of Mind

Within the MIND portfolio, Money capital occupies a foundational position. While all four components exhibit interdependence, degradation of monetary systems cascades into all other domains with particular severity. Understanding this primacy is essential for grasping why the Strategic Bitcoin Reserve represents critical AGI infrastructure.[12.11]

How Monetary Degradation Undermines Mind

Information Capital Impact: Inflation injects noise into price signals, the primary information system of market economies. When currency loses purchasing power at variable rates, price changes reflect monetary debasement rather than genuine supply-demand shifts. Economic actors cannot distinguish signal from noise, leading to systematic misallocation including AI research investment.[12.12]

Network Capital Impact: Monetary instability erodes trust across all social dimensions. Contracts denominated in depreciating currency become unreliable. Long-term partnerships become difficult to structure. The social fabric enabling complex collaboration—essential for alignment research—frays as participants cannot trust agreements will retain intended meaning.[12.13]

Data Capital Impact: High time preference induced by monetary degradation shifts societal attention toward short-term, immediate concerns and away from the diverse, long-term thinking that generates valuable training data. Academic research shifts toward quick publications over deep investigations. Media optimizes for engagement over accuracy.[12.14]

Monetary Issue | Mechanism | MIND Portfolio Impact |

Currency Debasement | Purchasing power loss compounds over decades | I: Corrupted price signals; N: Eroded trust; D: Short-term focus reduces variety |

Capital Controls | Government restricts value movement across borders | I: Blocked market signals; N: Impeded collaboration; D: Isolated data pools |

Financial Surveillance | All transactions monitored, potentially censored | I: Self-censorship; N: Trust collapse; D: Avoidance of sensitive research |

Bail-in Risk | Savings subject to confiscation during stress | I: Capital flight; N: Institutional distrust; D: Brain drain |

Table 12.3: Monetary Degradation Cascades Through the Mind Portfolio.

Bitcoin as Mind Portfolio Optimization

Bitcoin's properties directly address each vector of monetary degradation:[12.15]

Fixed Supply: The 21 million cap eliminates debasement risk. Economic actors can engage in long-term planning knowing savings will not be diluted. This structural certainty lowers time preference across society, enabling the patient, multi-generational thinking that alignment research requires.

Permissionless Operation: No authority can block transactions or freeze accounts. Researchers and institutions collaborate across jurisdictions without intermediary permission. The Network capital required for global alignment efforts flourishes without political interference.

Transparent Verification: Every participant can verify the monetary base and validate transactions independently. This eliminates information asymmetries characterizing fiat systems and enables the high-trust environment necessary for collaborative innovation.

Seizure Resistance: Properly secured bitcoin cannot be confiscated. Researchers can pursue controversial but important lines of inquiry without fear their funding will be seized. The Data variety required for robust alignment testing can emerge from diverse, independently funded efforts.[12.16]

Strategic Bitcoin Reserve as Agi Infrastructure

The Strategic Bitcoin Reserve transcends conventional concepts of reserve assets. Within the MIND portfolio framework, sovereign bitcoin accumulation represents infrastructure investment for AGI competition—the monetary foundation enabling a society to maintain the openness, trust, and variety required to develop beneficial superintelligence.[12.17]

The Preservation Function

Open societies face a structural vulnerability in the AGI race. Their very openness—the source of MIND portfolio strength—makes them susceptible to exploitation by closed competitors. Authoritarian systems can leverage open-society research while protecting their own efforts. They can attract talent trained in open environments while restricting return flows.[12.18]

The Strategic Bitcoin Reserve provides defensive infrastructure against these asymmetric vulnerabilities. By holding substantial reserves in an asset that cannot be sanctioned, frozen, or devalued by external actors, nations preserve capacity for independent action. This monetary sovereignty enables continued investment in open institutions even during geopolitical stress.[12.19]

The Signaling Function

Sovereign bitcoin accumulation signals commitment to monetary integrity over unlimited time horizons. Unlike fiat reserves printable at will, bitcoin holdings represent genuine sacrifice—accumulation of scarce resources that could have been spent elsewhere. This credible commitment attracts:[12.20]

Talent: Researchers and engineers seeking stable, long-term environments gravitate toward nations demonstrating commitment to monetary stability. The brain drain afflicting monetarily unstable societies can reverse.

Capital: Long-term investors require confidence returns will not be inflated away. Nations with substantial bitcoin reserves demonstrate the low time preference attracting patient capital for research infrastructure.

Cooperation: International alignment efforts require trust that participating nations will honor commitments. Bitcoin reserves, verifiable on-chain by any party, provide credible evidence of good faith.[12.21]

SBR Function | Mechanism | MIND Impact | AGI Advantage |

Debasement Hedge | Fixed supply asset in treasury | M: Preserved purchasing power | Sustained R&D investment |

Sanction Resistance | Unseizable reserve asset | N: Maintained international ties | Continued collaboration |

Talent Attraction | Signals long-term commitment | I: Knowledge concentration | Research leadership |

Citizen Dividend | Appreciation shared widely | D: Broad participation enabled | Diverse perspectives |

Table 12.4: Strategic Bitcoin Reserve Impact on Mind Portfolio and Agi Competitiveness.

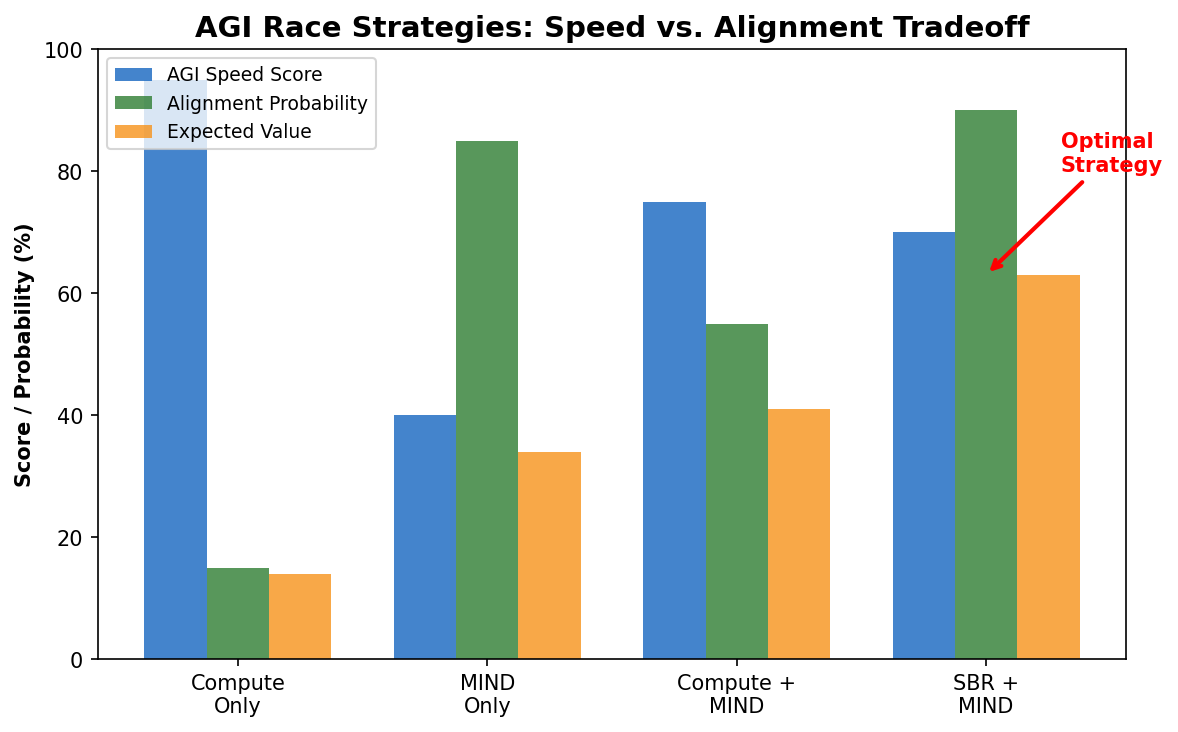

Game Theory of the Agi Race

The AGI race context transforms the game theory of sovereign bitcoin accumulation. Traditional analysis focuses on reserve asset diversification and inflation hedging. The MIND portfolio framework reveals deeper strategic dynamics with potentially civilizational stakes.[12.22]

The Alignment Dilemma

Nations face a fundamental strategic choice: prioritize short-term computational advantages or invest in the institutional foundations necessary for beneficial AGI. This creates a multi-player game with asymmetric payoffs:[12.23]

Scenario A (Compute Race Only): All nations focus exclusively on GPU accumulation. The 'winner' achieves powerful but potentially unaligned AGI. Outcome is potentially catastrophic for all players, including the 'winner.'

Scenario B (Mind Portfolio Investment): Nations that invest in monetary sovereignty, open institutions, and trust networks may trail in raw compute but lead in alignment capability. If any player achieves aligned AGI, that player achieves sustainable advantage.

Scenario C (Mixed Strategy): Some nations pursue pure compute while others maintain MIND portfolios. The race becomes alignment versus unalignment—with civilizational stakes depending on which approach achieves AGI first.[12.24]

Strategy Combination | Likely Outcome | Global Welfare |

All pursue compute only | Unaligned AGI emerges | Potentially catastrophic |

All maintain MIND portfolios | Aligned AGI emerges (slower) | Optimal (positive sum) |

Mixed: some compute, some MIND | Race between aligned and unaligned | Uncertain (timing dependent) |

Leader invests MIND + SBR | Leader achieves aligned AGI first | Optimal for leader, beneficial for all |

Table 12.5: Agi Race Game Theory Matrix—Mind Investment vs. Pure Compute.

First-Mover Advantages in Sbr Adoption

The Strategic Bitcoin Reserve offers unique first-mover advantages in the AGI race context:[12.25]

Supply Scarcity: Only 21 million bitcoin will ever exist. Early accumulating nations secure larger shares of this fixed resource. As the connection between monetary sovereignty and MIND portfolios becomes clearer, competition for limited supply will intensify.

Infrastructure Lead: Building custody, integration, and policy frameworks for sovereign bitcoin management takes years. Nations beginning accumulation now develop institutional capacity that cannot be rapidly replicated.

Talent Magnetism: The signaling effect of early SBR adoption attracts forward-thinking researchers and institutions. This human capital accumulation compounds over time, creating durable advantages in talent-driven AGI competition.[12.26]

Current Sovereign Positioning

Nation | SBR Status | Holdings | MIND Assessment |

United States | Active | ~200K BTC* | Strong base; SBR reinforces M, strengthens all |

El Salvador | Pioneer | 6,000+ BTC | M strengthening; I/N/D developing |

China | Restricted | ~190K (seized) | Compute-focused; N/D structurally constrained |

European Union | Debating | Minimal | I/N/D strong; M vulnerable (ECB policy) |

UAE/Gulf | Building | Undisclosed | M diversifying rapidly; N/D moderate |

Table 12.6: Sovereign Bitcoin Positioning and Mind Portfolio Status (as of early 2025). *US holdings primarily from seizures; SBR accumulation policy evolving.

The Alignment Problem Requires Open Societies

The connection between Strategic Bitcoin Reserves and AGI alignment runs deeper than monetary stability. The alignment problem—ensuring superintelligent systems remain beneficial to humanity—is fundamentally a challenge that only open societies are well-positioned to address.[12.27]

Alignment as Value Aggregation

Aligning AGI with human values presupposes determining what human values are. This is not a technical problem with a technical solution—it is a social and political challenge requiring mechanisms to aggregate diverse preferences across billions of humans with conflicting interests, values, and worldviews.[12.28]

Open societies have developed such mechanisms over centuries: democratic deliberation, free press, academic freedom, market signals, civil society, and legal systems protecting dissent. These institutions—the N and D components of the MIND portfolio—are precisely what authoritarian systems weaken in pursuit of control.

An AGI system aligned with values as defined by any single political authority—rather than through genuine deliberation—risks misalignment with the broader population whose preferences cannot be freely expressed. Only societies maintaining robust mechanisms for genuine preference revelation can produce AGI aligned with actual human values.[12.29]

Alignment as Iterative Correction

Alignment is not a one-time achievement but an ongoing process of identifying failures and correcting course. This iterative process requires:[12.30]

Honest Failure Reporting: Researchers must report near-misses and concerning behaviors without fear of punishment. This requires high N capital—trust that honesty will not be punished.

Diverse Testing Perspectives: Systems must be probed from multiple viewpoints to identify blind spots. This requires high D capital—variety of perspectives in the testing community.

Long-term Commitment: Alignment work often lacks short-term payoffs and requires patient investment. This requires high M capital—monetary stability enabling long time horizons.

Information Flow: Insights must propagate rapidly across the research community. This requires high I capital—free information flow unimpeded by censorship.[12.31]

Sbr as Alignment Infrastructure

The Strategic Bitcoin Reserve directly supports alignment capacity by strengthening the monetary foundation upon which other MIND components rest:[12.32]

Funding Independence: Alignment research can be funded through appreciation of bitcoin reserves rather than capture-prone mechanisms like government grants or corporate sponsorship. This enables pursuit of unpopular but important research directions.

International Cooperation: Alignment is a global challenge requiring global cooperation. Bitcoin reserves enable continued collaboration even during geopolitical stress when traditional payment rails may be weaponized.

Generational Commitment: Alignment may require decades of patient work. Bitcoin's properties as a multigenerational store of value enable credible commitment to research programs outlasting individual researchers, administrations, or political systems.[12.33]

From Strategic Reserve to Civilizational Resilience

The Strategic Bitcoin Reserve ultimately represents more than a financial instrument or AGI infrastructure. It embodies a civilizational commitment to the conditions necessary for human flourishing in an era of machine superintelligence.[12.34]

The Universal Basic Capital Trajectory

As sovereign bitcoin holdings appreciate, political pressure will build to distribute gains to citizens. This opens a path toward Universal Basic Capital—a citizen birthright of bitcoin providing passive income through appreciation rather than redistribution. Chapter 14 develops this concept in detail.[12.35]

Within the MIND portfolio framework, broad bitcoin distribution strengthens all components:

Money Capital: Individual savings protected from debasement enable household-level low time preference.

Information Capital: Economically independent citizens can pursue diverse interests and generate varied information.

Network Capital: Financial security enables trust-building activities and reduces zero-sum competition.

Data Capital: A diverse, financially secure population generates richer, more varied data.[12.36]

Preserving Human Agency Post-Agi

The ultimate purpose of maintaining a healthy MIND portfolio through the AGI transition is preserving human agency in a world of superintelligent machines. Economic independence—enabled by bitcoin holdings appreciating with technological progress—ensures humans retain meaningful choices even when AI systems surpass human cognitive capabilities.[12.37]

Nations accumulating Strategic Bitcoin Reserves are not merely hedging financial risk or competing for geopolitical advantage. They are investing in civilizational infrastructure necessary for humans to remain relevant, autonomous, and flourishing in the post-AGI world.[12.38]

The Race Worth Winning

The Great AGI Race will not be won by the nation with the most GPUs. It will be won by the society maintaining the healthiest MIND portfolio—the optimal combination of Money, Information, Network, and Data capital that enables genuine innovation and, crucially, alignment.[12.39]

Closed, authoritarian systems may accumulate computational resources, but they face structural obstacles in fostering the trust, variety, and honest collaboration that alignment requires. Their MIND portfolio deficits suggest that any AGI they produce carries elevated risks of misalignment—optimized for control rather than flourishing.

The Strategic Bitcoin Reserve provides the monetary foundation for maintaining open, high-trust, diverse societies through the AGI transition. By securing wealth in an incorruptible, unseizable, verifiable asset, nations preserve capacity for the long-term thinking, international cooperation, and honest inquiry that solving alignment demands.[12.40]

The race to establish a Strategic Bitcoin Reserve is not merely a competition for reserve assets. It is a race to build the civilizational infrastructure necessary for beneficial superintelligence. The nation that succeeds—by accumulating bitcoin, distributing gains broadly, and maintaining healthy MIND portfolios—will not merely survive the AGI transition. It will thrive, potentially leading humanity into an era of unprecedented flourishing.

This is the race worth winning. This is why monetary sovereignty matters. And as the preceding chapters have argued—from the thermodynamic security of proof-of-work (Chapter 3) to the deflationary alignment with technological progress (Chapter 9)—this is why Bitcoin, fundamentally, is about time.[12.41]

References

[12.1] Lee, K. (2018). AI Superpowers: China, Silicon Valley, and the New World Order. Houghton Mifflin.

[12.2] Analysis building on Mostaque, E. (2024). Public commentary on AGI competition dynamics and institutional requirements. Stability AI.

[12.3] Henrich, J. (2020). The WEIRDest People in the World. Farrar, Straus and Giroux.

[12.4] Acemoglu, D. & Robinson, J. (2012). Why Nations Fail. Crown Business.

[12.5] Putnam, R. (2000). Bowling Alone: The Collapse and Revival of American Community. Simon & Schuster.

[12.6] Russell, S. (2019). Human Compatible: Artificial Intelligence and the Problem of Control. Viking.

[12.7] Xu, B. & Albert, R. (2014). 'How Censorship in China Allows Government Criticism.' Political Science Quarterly.

[12.8] Bender, E., et al. (2021). 'On the Dangers of Stochastic Parrots.' FAccT Conference Proceedings.

[12.9] Gabriel, I. (2020). 'Artificial Intelligence, Values, and Alignment.' Minds and Machines 30(3).

[12.10] Ord, T. (2020). The Precipice: Existential Risk and the Future of Humanity. Hachette.

[12.11] Hayek, F. (1945). 'The Use of Knowledge in Society.' American Economic Review 35(4).

[12.12] Ammous, S. (2018). The Bitcoin Standard. Wiley.

[12.13] Fukuyama, F. (1995). Trust: The Social Virtues and the Creation of Prosperity. Free Press.

[12.14] Booth, J. (2020). The Price of Tomorrow. Stanley Press.

[12.15] Nakamoto, S. (2008). 'Bitcoin: A Peer-to-Peer Electronic Cash System.'

[12.16] Gladstein, A. (2022). Check Your Financial Privilege. BTC Media.

[12.17] Lowery, J. (2023). Softwar: A Novel Theory on Power Projection. MIT Press.

[12.18] Allison, G. (2017). Destined for War. Houghton Mifflin Harcourt.

[12.19] Saylor, M. (2024). '21 Million: The Implications of Absolute Scarcity.' MicroStrategy.

[12.20] Florida, R. (2019). The Rise of the Creative Class. Basic Books.

[12.21] Ostrom, E. (1990). Governing the Commons. Cambridge University Press.

[12.22] Schelling, T. (1960). The Strategy of Conflict. Harvard University Press.

[12.23] Bostrom, N. (2014). Superintelligence: Paths, Dangers, Strategies. Oxford University Press.

[12.24] Armstrong, S., et al. (2016). 'Racing to the Precipice.' AI & Society 31(2).

[12.25] Fidelity Digital Assets (2024). 'Institutional Bitcoin Infrastructure Report.'

[12.26] World Economic Forum (2024). 'Global Talent Competitiveness Index.'

[12.27] Christiano, P. (2023). 'What Failure Looks Like.' AI Alignment Forum.

[12.28] Sen, A. (1999). Development as Freedom. Oxford University Press.

[12.29] Rawls, J. (1971). A Theory of Justice. Harvard University Press.

[12.30] Amodei, D. (2024). 'Machines of Loving Grace.' Anthropic Research.

[12.31] Tegmark, M. (2017). Life 3.0: Being Human in the Age of AI. Knopf.

[12.32] Breedlove, R. (2023). 'Masters and Slaves of Money.' What is Money? Podcast.

[12.33] Drexler, K. (2019). 'Reframing Superintelligence.' Future of Humanity Institute.

[12.34] See Chapter 14: Universal Basic Capital as Constitutional Foundation.

[12.35] Analysis extending Alaska Permanent Fund model to bitcoin context. See Goldsmith, S. (2012).

[12.36] Christiano, P. & Amodei, D. (2024). 'AI Alignment: State of the Field.' Proceedings of NeurIPS.

[12.37] Integration of ZeroPoint framework with institutional analysis.

[12.38] Mostaque, E. (2024). 'Winning the AGI Race.' Keynote Address, AI Safety Summit.

[12.39] Synthesis of monetary sovereignty with civilizational outcomes.

[12.40] Author's concluding integration connecting thermodynamic, monetary, and institutional arguments.

[12.41] Connecting to the book's central thesis on Bitcoin and time.

Page

Coming Soon

This chapter will be available soon.