Part 1: FOUNDATIONS · Chapter 3

Time Preference: The Root Variable of Civilization

Introduction

Every economic decision is fundamentally a decision about time. When an individual chooses to save rather than consume, to invest rather than spend, or to build rather than extract, they are making a temporal choice—sacrificing present satisfaction for anticipated future benefit. The temporal orientation of economic actors collectively determines the character and trajectory of their civilization.

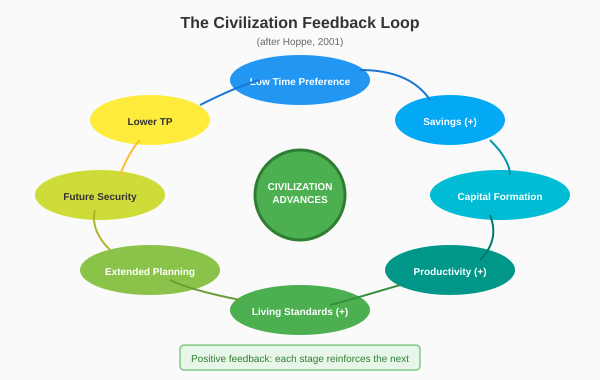

Austrian economists recognized this truth long before Bitcoin existed. Hans-Hermann Hoppe, in Democracy: The God That Failed (2001), argued that once time preference falls sufficiently low to permit savings and capital formation, a self-reinforcing positive feedback loop is initiated—what he termed the "process of civilization" [3.1]. The inverse is equally true: rising time preference drives de-civilization as capital is consumed, planning horizons shrink, and the future is sacrificed for the present.

The Dual Engine Framework

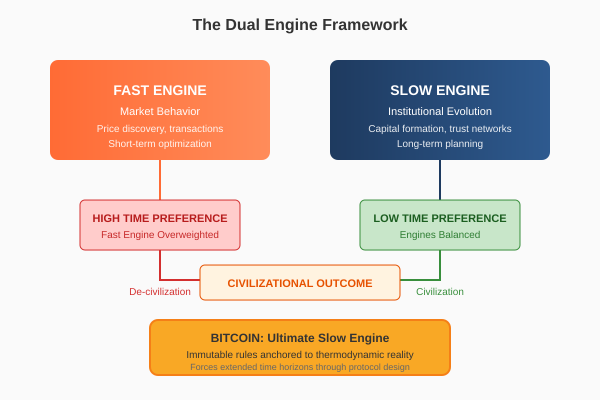

Mostaque's Dual Engine framework provides a mechanism for understanding time preference at civilizational scale [3.5]. Societies operate through two complementary engines: the Fast Engine of market behavior—price discovery, immediate transactions, short-term optimization—and the Slow Engine of institutional evolution—capital formation, trust networks, long-term planning, and durable foundations.

Healthy civilizations balance both engines. The Fast Engine provides responsiveness—markets discover prices, allocate resources, and signal opportunities. The Slow Engine provides durability—institutions accumulate trust, infrastructure embodies investment, and cultural norms encode wisdom across generations. Neither engine alone suffices. Pure market optimization without institutional foundation produces chaos; institutional rigidity without market feedback produces stagnation.

Time preference determines the balance. High time preference societies overweight the Fast Engine, pursuing immediate transactions at the expense of slow institutional development. Low time preference societies balance both engines, allowing market discovery while building durable institutional foundations that outlive their founders—the cathedrals, universities, and legal frameworks that define civilization [3.1].

MIND-State Dependent Discounting

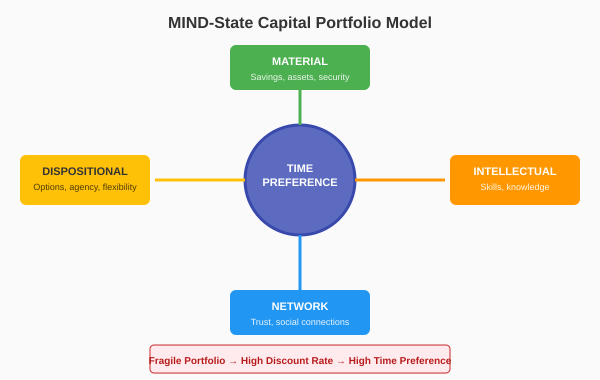

Mostaque's MIND-State Dependent Discounting model provides the microeconomic foundation for understanding how aggregate time preference emerges from individual circumstances [3.5]. The model posits that agents with fragile or deficient capital portfolios are compelled by systemic instability to discount the future heavily. A society with widespread precarity is therefore a society with structurally high discount rates.

The capital portfolio consists of four components: Material Capital (savings, assets, physical security), Intellectual Capital (skills, knowledge, human capital), Network Capital (trust relationships, social connections), and Dispositional Capital (future options, agency, flexibility). When any component is deficient, rational actors must discount future outcomes more heavily—uncertainty about whether future rewards will materialize makes present consumption the safer choice.

Table 3.1: MIND-State Capital Components and Time Preference Effects

Capital Type | When Deficient | Effect on Discount Rate |

Material | No savings buffer; asset insecurity | Increases (+): Necessitates immediate consumption |

Intellectual | Limited skills; uncertain employability | Increases (+): Future income uncertain |

Network | Weak trust networks; social isolation | Increases (+): No safety net; contracts unreliable |

Dispositional | Few options; constrained agency | Increases (+): Future paths blocked |

Note: (+) indicates discount rate increases, leading to higher time preference.

This framework explains the Rochester replication of Mischel's marshmallow test [3.7], where children in the "unreliable" condition (broken promises) waited approximately one-quarter as long as those in the "reliable" condition (mean of roughly 3 minutes versus 12 minutes). The children were not demonstrating inferior character; they were rationally responding to demonstrated institutional unreliability. When Network Capital (trust) is deficient, high time preference is adaptive.

Fiat Currency and Systematic Capital Destruction

Fiat monetary policy manipulates the Fast Engine through interest rate adjustments and stimulus programs while systematically degrading the Slow Engine foundations that enable low time preference. This degradation operates through both Material Capital destruction (inflation eroding savings) and Network Capital erosion (institutional trust decay).

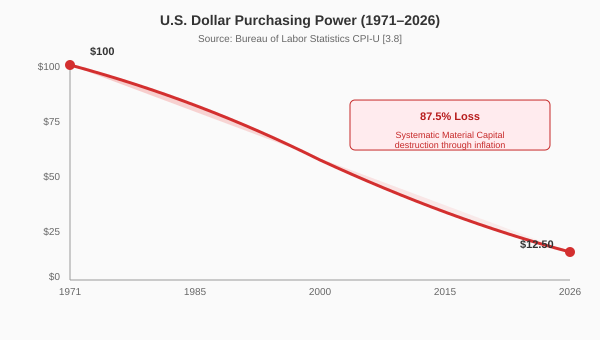

Consider Material Capital: according to Bureau of Labor Statistics CPI data [3.8], $100 saved in 1971 retains only $12.50 of purchasing power in 2026—an 87.5% destruction of stored value. This is not abstract economics—it represents the systematic expropriation of human time. The rational response to guaranteed currency depreciation is to minimize savings, increase consumption, and seek alternative stores of value—precisely the high time preference behaviors that Hoppe identifies with de-civilization.

Network Capital suffers parallel degradation. When monetary authorities repeatedly demonstrate willingness to inflate away obligations, institutional trust erodes. Savers learn that promises denominated in fiat currency cannot be trusted across time. Contracts become less reliable. The social infrastructure enabling long-term planning deteriorates. As Ammous documents [3.4], hyperinflationary environments destroy not just economies but social fabric itself—fruit-bearing trees chopped for firewood, seed corn eaten, the future discounted toward zero.

The dual degradation of Material and Network Capital under fiat regimes interrupts the positive feedback loop that Hoppe identified as the engine of civilizational progress. When savings cannot preserve value and institutional promises cannot be trusted, the Slow Engine stalls—and with it, the civilizational trajectory reverses.

The Civilization Feedback Loop

Hoppe's central insight is that time preference and capital accumulation exist in a reflexive relationship—a positive feedback loop in which each variable reinforces the other [3.1]. When time preference falls sufficiently to permit savings, capital accumulates, productivity rises, living standards improve, and time preference falls further. This is the Slow Engine operating at civilizational scale.

Historical evidence supports this mechanism, though other factors—institutional development, political stability, monetary innovation—also contributed. European interest rates declined from approximately 8% in the thirteenth century to 2.5% in the nineteenth century [3.1]. Hoppe interprets this secular decline as reflecting falling aggregate time preference as capital accumulated and institutions strengthened. The physical evidence is equally visible: cathedrals that took centuries to complete, infrastructure designed to serve generations, legal codes intended to outlive their authors.

The inverse loop is equally powerful. When circumstances cause individuals to view savings as unsafe, time preferences rise. Capital is consumed. Planning horizons shrink. Infrastructure decays. Each degradation makes the next more likely. This is de-civilization—the Slow Engine failing while the Fast Engine spins ever faster toward immediate gratification.

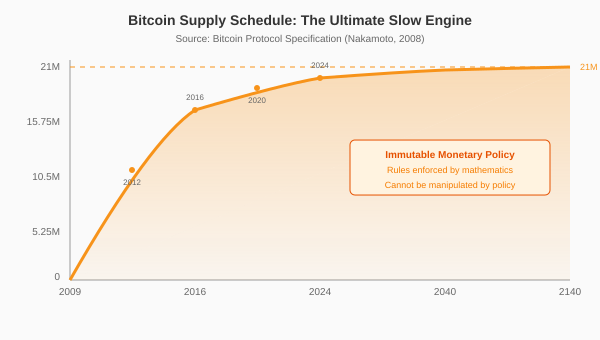

Bitcoin: The Ultimate Slow Engine

Bitcoin represents a technological innovation explicitly designed to enforce low time preference through its fundamental architecture. Its fixed supply schedule and proof-of-work consensus mechanism create what might be termed the ultimate Slow Engine—immutable rules that cannot be manipulated by short-term policy, forcing economic actors to extend their time horizons.

Unlike fiat currencies subject to policy manipulation, Bitcoin's monetary policy is determined by code—21 million units maximum, halving every 210,000 blocks, asymptotically approaching final supply circa 2140 [3.4]. No central authority can accelerate issuance, no political pressure can expand supply, no emergency can justify debasement. The rules are enforced by mathematics and thermodynamics rather than institutional commitment.

The MIND-State framework provides a physical justification for the claim that sound money lowers societal time preference. It is not merely that individuals prefer money that holds value—though they do. It is that sound money preserves the Material Capital (savings) and Network Capital (trust) that enable psychological long-term thinking. Bitcoin's preservation of purchasing power across time provides the baseline security necessary for low time preference.

When an individual knows their savings cannot be inflated away, their Material Capital portfolio strengthens. When monetary rules are verifiable and immutable, Network Capital in the form of institutional trust becomes unnecessary—replaced by cryptographic verification without institutional intermediaries. When future purchasing power is predictable, Dispositional Capital expands as planning becomes meaningful. The entire capital portfolio that determines discount rates is strengthened by sound money.

Proof-of-work adds a thermodynamic anchor. Unlike fiat currencies created by decree, Bitcoin requires verifiable energy expenditure—approximately 150 terawatt-hours annually [3.10]. This creates what Nick Szabo termed "unforgeable costliness" [3.11], linking digital value to physical reality through the laws of thermodynamics. The Slow Engine is not merely institutional but physical—grounded in energy rather than promises.

Table 3.2: Monetary Systems and the Dual Engine Framework

Dimension | Fiat Currency | Bitcoin |

Fast Engine Effect | Manipulated via rates, stimulus | Market-determined; no manipulation |

Slow Engine Effect | Degraded (−): savings, trust eroded | Strengthened (+): immutable rules |

Material Capital | Destroyed (−): inflation erodes | Preserved (+): fixed supply |

Network Capital | Eroded (−): broken promises | Obviated (+): cryptographic verification |

Time Preference Effect | Structurally raised (−) | Structurally lowered (+) |

Note: (+) indicates positive effect on civilizational trajectory; (−) indicates negative effect.

Conclusion

This chapter has examined time preference as the root variable of civilization, integrating Austrian economic theory with Mostaque's Dual Engine and MIND-State frameworks to provide both mechanism and microeconomic foundation for understanding how monetary systems shape civilizational trajectories.

Societies require both engines: the Fast Engine of market responsiveness and the Slow Engine of institutional durability. Fiat monetary systems manipulate the Fast Engine while systematically degrading the Slow Engine foundations—the Material Capital (savings) and Network Capital (trust) that enable low time preference. The result is structurally elevated discount rates and the civilizational decline Hoppe identified as de-civilization.

Bitcoin offers a technological alternative: the ultimate Slow Engine. Its fixed supply preserves Material Capital. Its immutable rules obviate the need for Network Capital in the form of institutional trust. Its proof-of-work anchors value to thermodynamic reality. By preserving the capital portfolios that enable psychological long-term thinking, Bitcoin provides the physical foundation for civilizational time preference to decline—initiating Hoppe's positive feedback loop not through political reform but through technological innovation.

Whether Bitcoin realizes its civilizational promise remains to be seen. What is clear is that it represents the first serious alternative to fiat monetary systems in over a century—an alternative designed from first principles to function as a Slow Engine that cannot be manipulated by short-term policy, forcing economic actors to extend their time horizons and rebuild the institutional foundations of civilization.

References

[3.1] Hoppe, H.-H. (2001). Democracy: The God That Failed. Transaction Publishers, pp. 1–43.

[3.2] Mises, L. v. (1949). Human Action: A Treatise on Economics. Yale University Press.

[3.3] Böhm-Bawerk, E. v. (1884). Capital and Interest. Macmillan.

[3.4] Ammous, S. (2018). The Bitcoin Standard: The Decentralized Alternative to Central Banking. Wiley, pp. 57–92.

[3.5] Mostaque, E. (2024). Dual Engine Framework and MIND-State Dependent Discounting. Public frameworks presented in interviews and commentary on economic systems. (As cited in author's correspondence.)

[3.6] Mischel, W., Shoda, Y., & Peake, P. K. (1990). Predicting adolescent cognitive and self-regulatory competencies from preschool delay of gratification. Developmental Psychology, 26(6), 978–986.

[3.7] Kidd, C., Palmeri, H., & Aslin, R. N. (2013). Rational snacking: Young children's decision-making on the marshmallow task is moderated by beliefs about environmental reliability. Cognition, 126(1), 109–114.

[3.8] U.S. Bureau of Labor Statistics. (2025). Consumer Price Index for All Urban Consumers (CPI-U). Retrieved from https://www.bls.gov/cpi/

[3.9] Hanke, S. H., & Krus, N. (2012). World Hyperinflations. Cato Working Paper, No. 8.

[3.10] Cambridge Centre for Alternative Finance. (2025). Cambridge Bitcoin Electricity Consumption Index. Retrieved from https://ccaf.io/cbeci

[3.11] Szabo, N. (2002). Shelling Out: The Origins of Money. Satoshi Nakamoto Institute. Retrieved from https://nakamotoinstitute.org/shelling-out/

Page

Coming Soon

This chapter will be available soon.