Part 1: FOUNDATIONS · Chapter 4

The Time Value of Money Is Broken

Introduction

The time value of money constitutes a cornerstone of financial theory, providing the mathematical foundation for asset valuation, capital budgeting, and debt market structuring.4.1 The principle states that a dollar received today is worth more than a dollar received in the future because today’s dollar can be invested to earn a return. This seemingly intuitive concept underlies virtually all of modern finance: discounted cash flow analysis, net present value calculations, internal rate of return metrics, and the entire structure of fixed-income securities.

Yet empirical evidence increasingly challenges the framework’s assumptions. Bitcoin has delivered compound annual returns exceeding 50% over its fifteen-year history, systematically defying DCF-based valuation models that predicted reversion to “fundamental value.”4.2 Technology equities routinely trade at multiples that traditional analysis deems irrational, only to justify those valuations through network-driven growth. These anomalies suggest that orthodox TVM captures only one dimension of how value actually moves through modern economies.

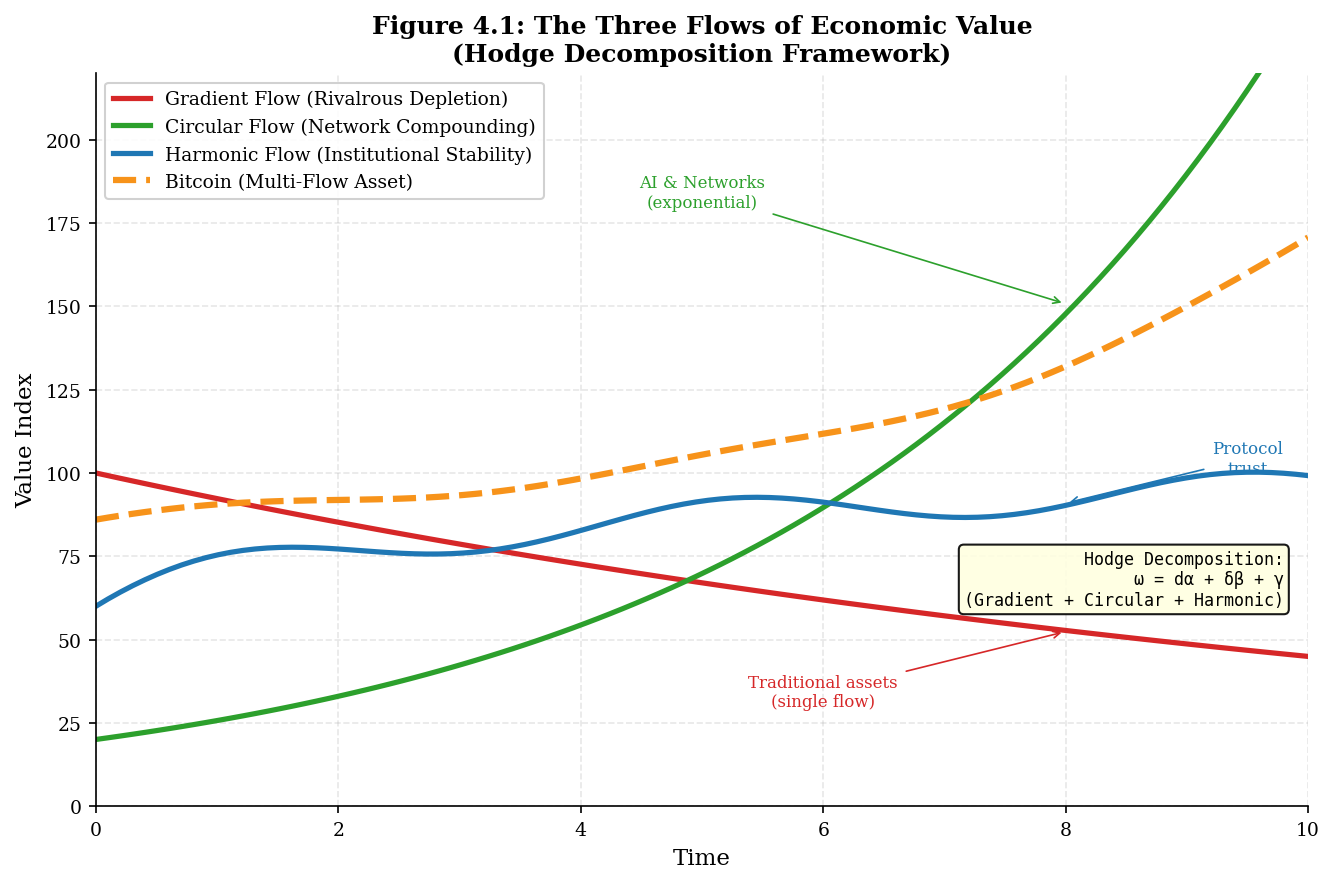

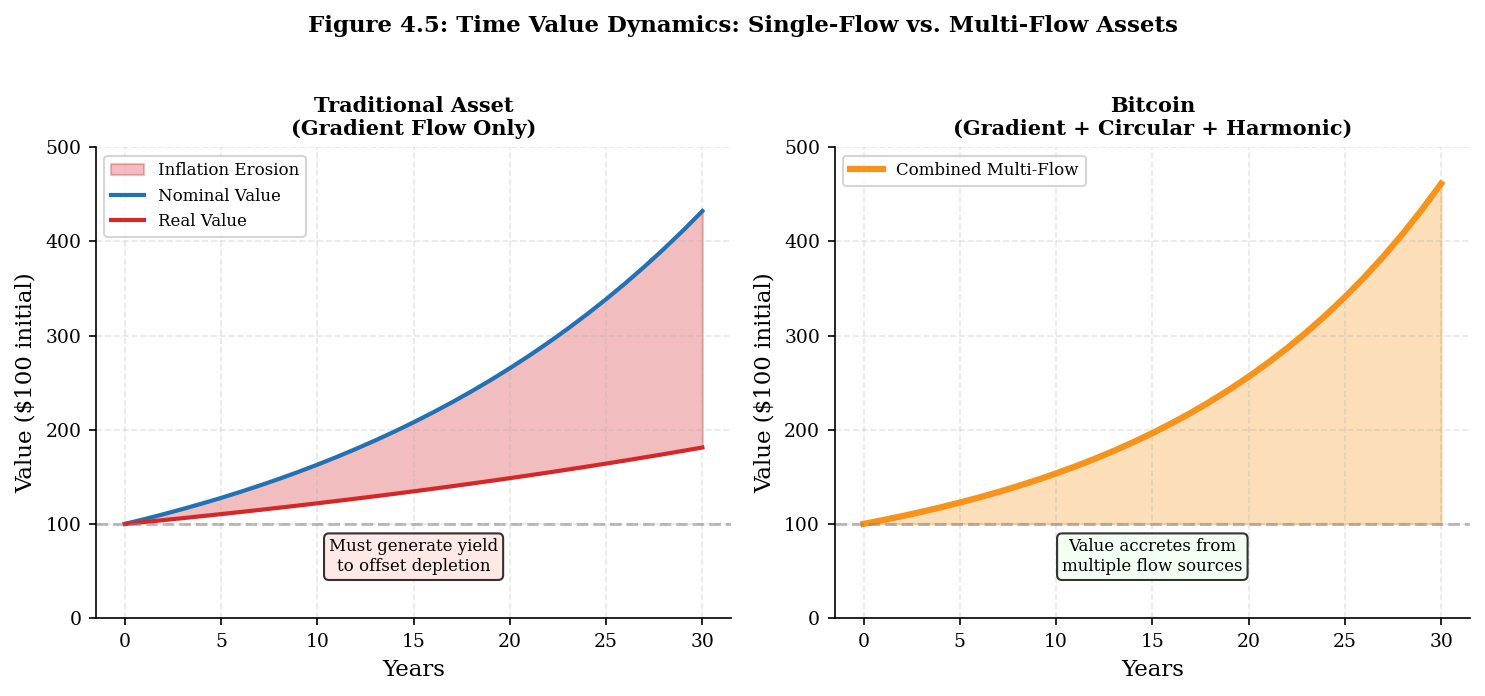

This chapter argues that the time value of money, as conventionally understood, represents not a universal law but a single-flow approximation inadequate for multi-flow assets. We introduce Emad Mostaque’s Three Flows framework, which draws conceptual inspiration from the Hodge Decomposition theorem in differential topology to reveal two additional value channels beyond traditional competitive exchange: self-amplifying Circular Flow (network effects, AI systems) and persistent Harmonic Flow (institutional trust). We demonstrate that Bitcoin operates across all three flows simultaneously, explaining its anomalous time-value behavior and positioning it as essential monetary infrastructure for the age of artificial intelligence.4.3

The chapter proceeds as follows. Section 4.2 develops the theoretical framework of the Three Flows. Section 4.3 examines how artificial intelligence accelerates Circular Flow dynamics. Section 4.4 reinterprets Piketty’s r > g finding through flow physics. Section 4.5 analyzes Bitcoin as a multi-flow asset. Section 4.6 explores Bitcoin’s potential as a structural equality mechanism. Section 4.7 discusses implications for valuation methodology and acknowledges limitations. Section 4.8 concludes.

The Three Flows of Economic Value

Emad Mostaque has proposed a framework for understanding economic value flows that draws conceptual inspiration from the Hodge Decomposition theorem in differential topology.4.4 The Hodge Decomposition states that any differential form on a compact Riemannian manifold can be uniquely decomposed into three orthogonal components: an exact form (gradient), a co-exact form (curl/circular), and a harmonic form.4.5

While the economic application represents an interpretive framework rather than a formal mathematical proof, the decomposition provides useful conceptual scaffolding for categorizing distinct mechanisms of value creation and transfer. Applied to economics, this yields three distinct “flows” of value, each exhibiting characteristic time dynamics.*

*Note: This framework should be distinguished from the Keynesian “circular flow of income” model, which describes aggregate demand relationships. Mostaque’s Circular Flow refers specifically to self-amplifying, non-rivalrous value dynamics.

Table 4.1: The Three Flows of Economic Value

Flow Type | Conceptual Basis | Economic Manifestation | Time Behavior |

Gradient | Exact form (conservative) | Rivalrous goods, competitive exchange | Depletes (entropy increases) |

Circular | Rotational form (non-conservative) | Non-rivalrous goods, networks, AI | Amplifies (self-reinforcing) |

Harmonic | Kernel form (persistent) | Trust, institutions, protocols | Persists (structural stability) |

Source: Adapted from Mostaque (2024); mathematical foundations in Hodge (1941).

Gradient Flow represents the traditional economic model: scarce resources competing for allocation, where one party’s gain implies another’s loss. Physical commodities, labor hours, and depreciating capital exhibit Gradient Flow characteristics. Value in this channel follows thermodynamic principles, dissipating toward equilibrium.4.6

Circular Flow operates through non-rivalrous goods where usage does not diminish availability. Software, knowledge, and network effects generate returns that amplify rather than deplete. Metcalfe’s Law, describing network value scaling with the square of nodes, exemplifies these dynamics.4.7 Artificial intelligence accelerates Circular Flow at unprecedented rates: AI systems improve through usage, creating recursive feedback loops that accumulate value at machine speed rather than human speed.4.8

Harmonic Flow represents persistent structural channels: institutional trust, legal frameworks, and protocol-level agreements that enable exchange. Unlike Gradient Flow (which depletes) or Circular Flow (which amplifies), Harmonic Flow provides stability: the enduring channels through which other flows move.4.9

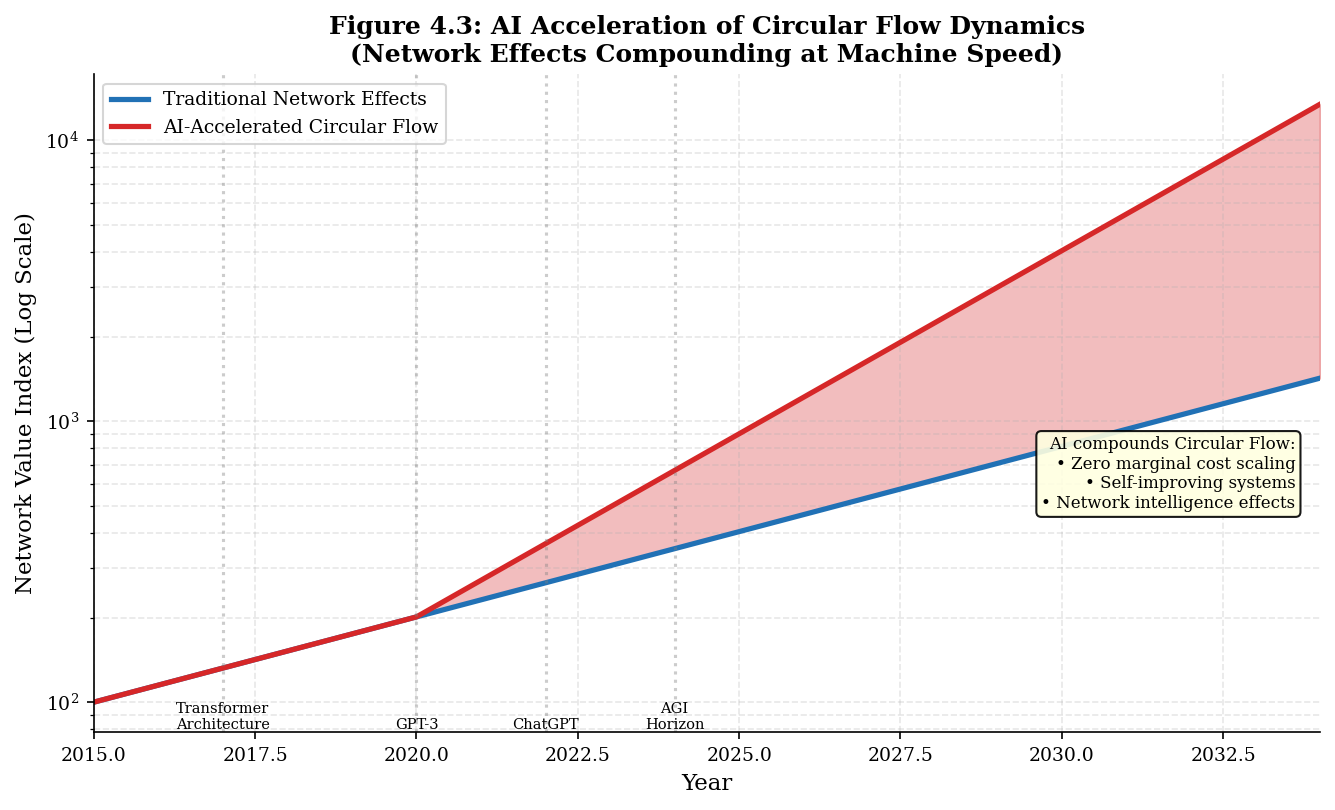

Artificial Intelligence and Circular Flow Acceleration

The emergence of artificial intelligence represents a phase transition in Circular Flow dynamics. Traditional network effects (telephones, social platforms, marketplaces) grow at rates bounded by human adoption and interaction speeds. AI systems transcend these limitations through three mechanisms:4.10

First, zero marginal cost scaling: once trained, AI models serve unlimited users with minimal incremental cost, generating pure Circular Flow value. Second, recursive self-improvement: AI systems that learn from deployment become more valuable through usage, establishing positive feedback loops that accumulate at machine speed.4.11 Third, network intelligence effects: interconnected AI systems create emergent capabilities exceeding their individual functions, generating super-linear returns to scale.

Table 4.2: AI Amplification of Circular Flow Returns

Mechanism | Pre-AI Era | AI Era |

Scaling Speed | Human adoption rates | Instantaneous deployment |

Marginal Cost | Declining but positive | Approaching zero |

Improvement Rate | Human learning speed | Recursive self-improvement |

Network Effects | Metcalfe’s Law (n²) | Accelerated network effects |

Value Capture | Platform owners | Increasingly autonomous systems |

Source: Author’s analysis based on Mostaque (2024); Agrawal, Gans, and Goldfarb (2022).

The implications for time value are profound. Traditional TVM assumes value depletes, requiring returns to compensate for depreciation and opportunity cost. But Circular Flow assets, particularly AI systems, appreciate through use. Their time value is effectively negative: delaying investment in Circular Flow assets means purchasing less value tomorrow, as the network will have grown further.4.12

Flow Physics and Piketty’s r > g

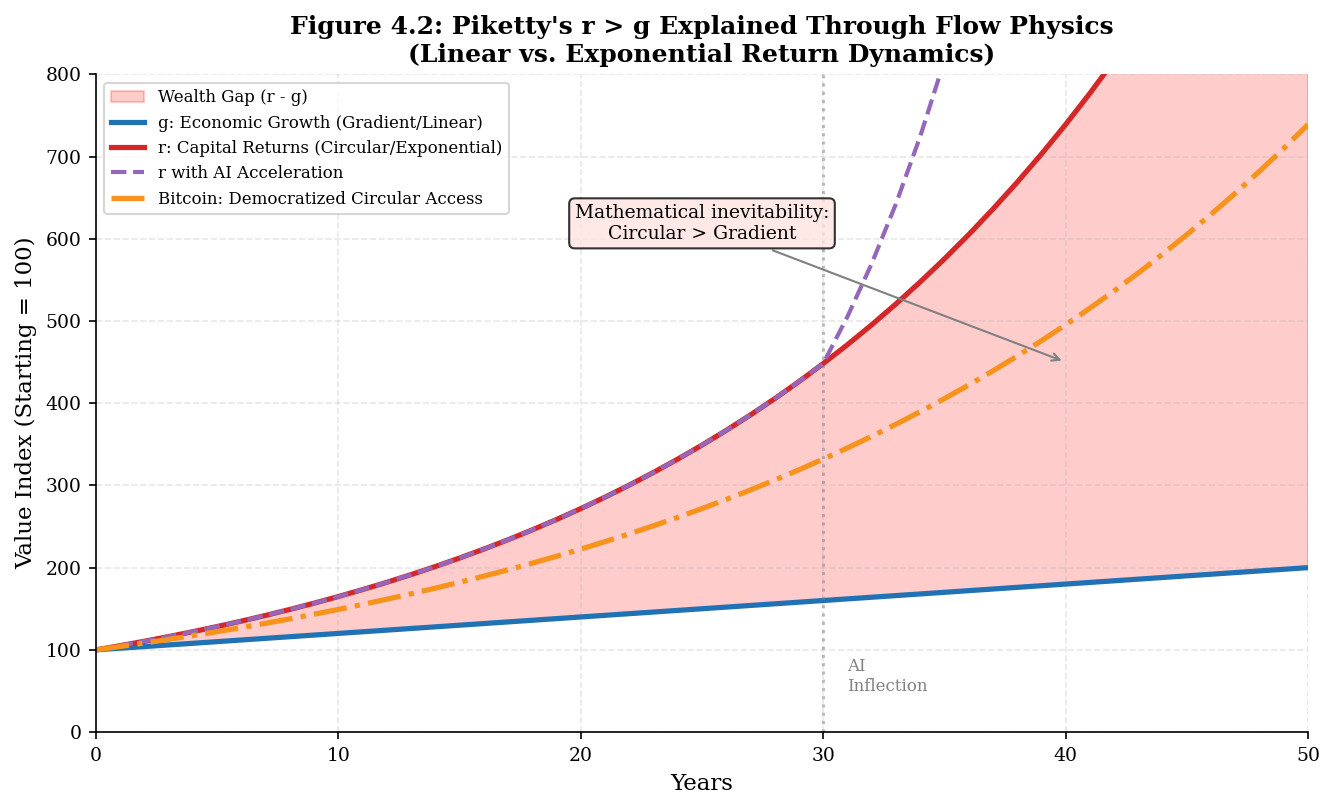

Thomas Piketty’s empirical finding that returns on capital (r) systematically exceed economic growth (g) has been widely interpreted as evidence of market failure requiring redistributive intervention.4.13 The Three Flows framework suggests an additional, structural explanation that complements rather than replaces institutional analyses: r > g may partly reflect the mathematical relationship between two different flow physics operating simultaneously.

Economic growth (g) is primarily generated through Gradient Flow: human labor transforming rivalrous inputs into outputs. This process is inherently linear, bounded by human hours, physical resources, and entropic limits. Even with productivity improvements, Gradient Flow value creation scales additively.

Capital returns (r), by contrast, increasingly derive from Circular Flow: ownership of networks, intellectual property, software systems, and AI. These assets generate exponential returns through non-rivalrous scaling and self-reinforcing dynamics. The mathematical relationship between linear and exponential functions ensures that, regardless of initial conditions, exponential growth eventually dominates.4.14

AI dramatically accelerates this divergence. As Circular Flow returns accumulate at machine speed, the gap between capital returns and labor income widens faster than redistributive policy can address. From this perspective, the fundamental challenge is not insufficient redistribution but asymmetric access to flow types: workers remain trapped in Gradient Flow (selling rivalrous labor hours) while capital owners capture Circular Flow returns (non-rivalrous, self-amplifying assets).4.15

Bitcoin as Multi-Flow Asset

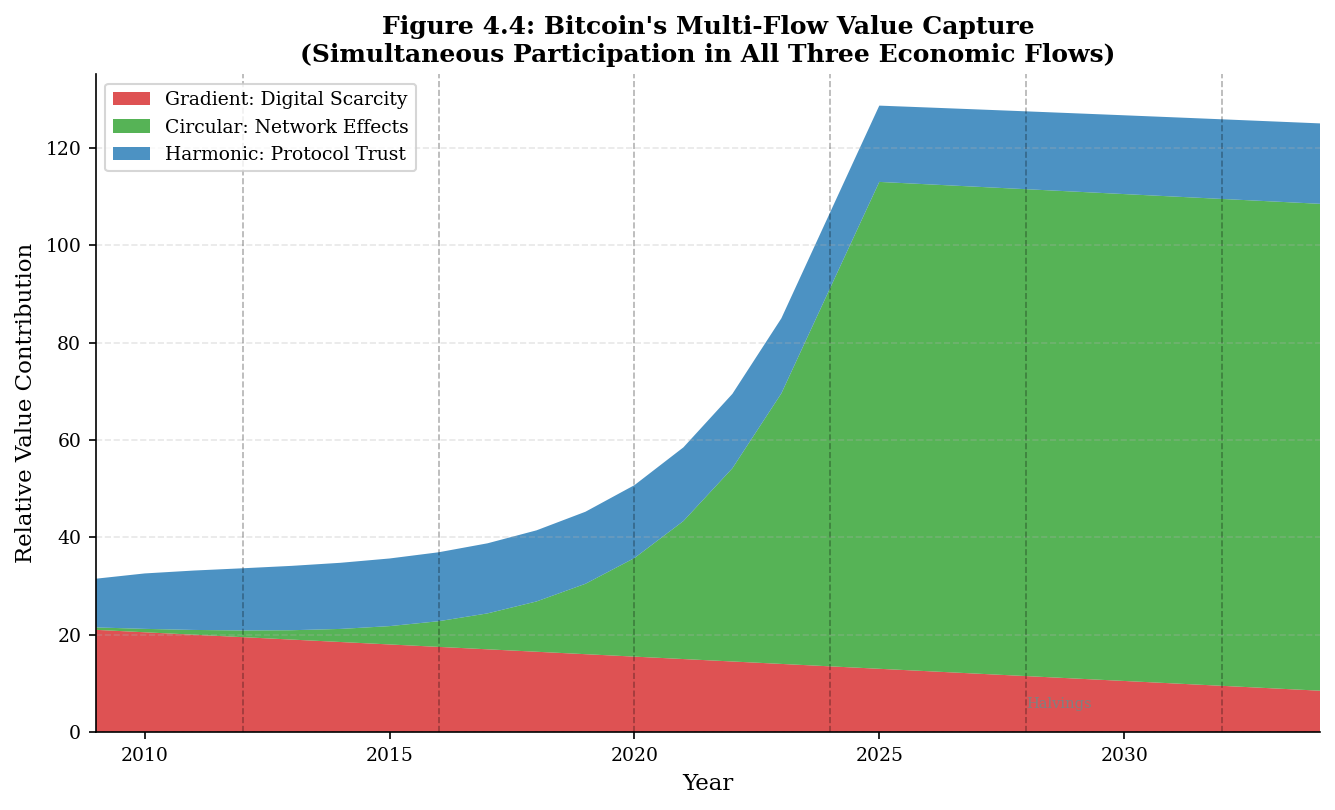

Bitcoin is the first asset class to participate simultaneously in all three economic flows, which helps explain its anomalous time-value behavior and its potential as a structural equality mechanism.4.16

Gradient Flow (Digital Scarcity): Bitcoin’s fixed supply of 21 million coins creates absolute scarcity, a pure Gradient Flow property. Unlike gold, which can be mined in greater quantities with sufficient investment, Bitcoin’s supply is cryptographically enforced. This generates traditional store-of-value characteristics.4.17

Circular Flow (Network Effects): Every new Bitcoin user increases the network’s utility for existing users. Transaction infrastructure, merchant acceptance, institutional adoption, and developer ecosystem create self-reinforcing value accumulation. Empirical research confirms that Bitcoin’s market capitalization correlates strongly with the square of active addresses, consistent with Metcalfe’s Law dynamics.4.18 These network effects are non-rivalrous: one user’s participation enhances rather than diminishes others’ experience.

Harmonic Flow (Protocol Trust): Bitcoin’s immutable protocol serves as institutional infrastructure, a Harmonic Flow channel through which value moves. The Lindy effect strengthens this channel: with each passing year that Bitcoin’s protocol remains unchanged, confidence in its continued stability increases.4.19 This represents pure institutional value accumulation independent of market price.

Table 4.3: Bitcoin’s Participation Across All Three Flows

Flow | Bitcoin Property | Value Mechanism | Time Behavior |

Gradient | 21M hard cap | Absolute scarcity | Appreciates vs. inflation |

Circular | Network adoption | Metcalfe dynamics | Amplifies with users |

Harmonic | Immutable protocol | Lindy effect | Strengthens over time |

Source: Author’s analysis.

Bitcoin as Structural Equality Mechanism

The Three Flows framework reframes Bitcoin’s significance beyond inflation hedge or store of value. Bitcoin represents the first mechanism enabling ordinary savers to participate in Circular Flow returns, previously accessible only to capital owners who could acquire equity in network businesses, AI companies, and platform monopolies.4.20

Traditional access to Circular Flow returns requires significant capital for meaningful equity stakes, sophisticated knowledge for venture investment, geographic proximity to technology ecosystems, or employment at network-effect companies with equity compensation. These barriers systematically exclude the majority of global workers from exponential returns, trapping them in linear Gradient Flow income.4.21

Bitcoin inverts this dynamic. Any individual, anywhere, can acquire Bitcoin exposure in arbitrarily small amounts. As the network grows, all holders participate proportionally in Circular Flow value creation. This represents structural rather than redistributive equality: rather than transferring value from Circular Flow winners to Gradient Flow participants, Bitcoin enables universal participation in self-amplifying returns.4.22

Table 4.4: Access to Circular Flow Returns

Dimension | Traditional (Tech Equity) | Bitcoin |

Minimum Investment | $10,000+ (venture); $100+ (public) | Any amount (1 satoshi ≈ $0.001) |

Geographic Access | Concentrated in tech hubs | Global, permissionless |

Knowledge Barrier | High (financial sophistication) | Low (simple custody) |

Intermediary Required | Brokers, VCs, banks | None (self-custody possible) |

Network Exposure | Single company/platform | Entire monetary network |

Source: Author’s analysis; World Bank Global Findex (2021).

Implications for Valuation in the AI Era

The Three Flows framework reveals why traditional time value calculations fail for multi-flow assets. Standard DCF analysis assumes single-flow (Gradient) dynamics: positive discount rates reflecting depreciation and inflation. Applying this methodology to Bitcoin systematically undervalues its Circular and Harmonic components.4.23

As AI accelerates Circular Flow dynamics, divergence between single-flow and multi-flow asset valuations will widen. Traditional assets (real estate, bonds, commodities) remain subject to Gradient Flow physics, requiring positive yields to compensate for depreciation. Multi-flow assets will capture value from multiple sources simultaneously.

For financial theory, this suggests fundamental revisions to valuation methodologies. Assets should be decomposed by flow type, with different discount rates (or appreciation rates) applied to each component. A Bitcoin valuation model might apply: a positive discount to the Gradient component (scarcity premium may erode with substitutes), a negative discount to the Circular component (network effects amplify), and zero discount to the Harmonic component (protocol trust persists).4.24

Limitations and Counterarguments

Several limitations warrant acknowledgment. First, Bitcoin’s historical volatility complicates claims regarding Harmonic stability; while the protocol remains immutable, price fluctuations of 50–80% within single years challenge characterization as a “stable channel.” The framework distinguishes protocol-level Harmonic properties from market-level price dynamics, but this distinction requires empirical validation.

Second, network effects may plateau following S-curve adoption dynamics rather than amplifying indefinitely. If Bitcoin approaches network saturation, Circular Flow returns would diminish, potentially reverting the asset toward single-flow (Gradient) characteristics. Historical precedents from telecommunications and social networks suggest such saturation is possible.

Third, regulatory intervention could constrain the “permissionless” access that enables Bitcoin’s equality mechanism. Jurisdictions implementing strict capital controls, KYC requirements, or outright prohibitions would reduce the universality of Circular Flow participation that distinguishes Bitcoin from traditional assets.

Conclusion

The time value of money, as conventionally understood, represents not a universal law but a single-flow approximation inadequate for multi-flow assets. Mostaque’s Three Flows framework, drawing conceptual inspiration from the Hodge Decomposition, provides a superior model for understanding value dynamics in economies increasingly dominated by AI and network effects.

Piketty’s r > g finding may reflect, in part, the mathematical relationship between exponential Circular Flow returns and linear Gradient Flow growth. AI acceleration widens this gap at machine speed, threatening unprecedented wealth concentration absent new mechanisms for Circular Flow access.

Bitcoin emerges as precisely such a mechanism: the first asset enabling universal participation in multi-flow value capture. Its unique combination of Gradient scarcity, Circular network effects, and Harmonic protocol trust explains its anomalous time-value behavior and positions it as essential monetary infrastructure for the age of artificial intelligence. The question is not whether the time value of money is broken, but whether we will build monetary systems aligned with the true physics of economic value.

Having established the theoretical framework for multi-flow value dynamics, Chapter 5 examines the empirical evidence for Bitcoin’s store-of-value function, quantifying the global wealth pools from which Bitcoin may capture monetary premium as AI-driven deflation reshapes asset valuations.

References

[4.1] Brealey, R.A., Myers, S.C., & Allen, F. (2020). Principles of Corporate Finance (13th ed.). McGraw-Hill Education.

[4.2] Alabi, K. (2017). Digital blockchain networks appear to be following Metcalfe’s Law. Electronic Commerce Research and Applications, 24, 23–29.

[4.3] Booth, J. (2020). The Price of Tomorrow: Why Deflation is the Key to an Abundant Future. Stanley Press.

[4.4] Mostaque, E. (2024). The Three Flows: A Mathematical Framework for Economic Value. Working Paper, Stability AI. Available upon request.

[4.5] Hodge, W.V.D. (1941). The Theory and Applications of Harmonic Integrals. Cambridge University Press.

[4.6] Georgescu-Roegen, N. (1971). The Entropy Law and the Economic Process. Harvard University Press.

[4.7] Metcalfe, R. (2013). Metcalfe’s Law after 40 years of Ethernet. IEEE Computer, 46(12), 26–31.

[4.8] Silver, D., et al. (2017). Mastering the game of Go without human knowledge. Nature, 550(7676), 354–359.

[4.9] North, D.C. (1990). Institutions, Institutional Change and Economic Performance. Cambridge University Press.

[4.10] Agrawal, A., Gans, J., & Goldfarb, A. (2022). Power and Prediction: The Disruptive Economics of Artificial Intelligence. Harvard Business Review Press.

[4.11] Anthropic. (2023). Constitutional AI: Harmlessness from AI Feedback. arXiv preprint arXiv:2212.08073.

[4.12] Brynjolfsson, E., & McAfee, A. (2014). The Second Machine Age. W.W. Norton & Company.

[4.13] Piketty, T. (2014). Capital in the Twenty-First Century. Harvard University Press.

[4.14] Romer, P. (1990). Endogenous technological change. Journal of Political Economy, 98(5), S71–S102.

[4.15] Korinek, A., & Stiglitz, J. (2021). Artificial Intelligence, Globalization, and Strategies for Economic Development. NBER Working Paper No. 28453, February 2021.

[4.16] Ammous, S. (2018). The Bitcoin Standard: The Decentralized Alternative to Central Banking. Wiley.

[4.17] Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. https://bitcoin.org/bitcoin.pdf.

[4.18] Peterson, T. (2018). Metcalfe’s Law as a Model for Bitcoin’s Value. Alternative Investment Analyst Review, 7(2), 9–18.

[4.19] Taleb, N.N. (2012). Antifragile: Things That Gain from Disorder. Random House.

[4.20] Saylor, M. (2020, September 15). Bitcoin for Corporations. MicroStrategy World Conference, Virtual. https://www.microstrategy.com/.

[4.21] World Bank. (2021). Global Findex Database 2021: Financial Inclusion, Digital Payments, and Resilience. Washington, DC.

[4.22] Gladstein, A. (2022). Check Your Financial Privilege. BTC Media.

[4.23] Damodaran, A. (2012). Investment Valuation: Tools and Techniques for Determining the Value of Any Asset (3rd ed.). Wiley.

[4.24] Burniske, C., & Tatar, J. (2018). Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond. McGraw-Hill Education.

Page

Coming Soon

This chapter will be available soon.