Part 3: TRANSFORMATION · Chapter 8

Money as Meme

Introduction

In 1976, Richard Dawkins introduced the concept of the "meme" in The Selfish Gene—a unit of cultural transmission that replicates through imitation, spreads through populations, and evolves through selective pressure [8.1]. Nearly half a century later, a pseudonymous creator named Satoshi Nakamoto unleashed what may be the most successful financial meme in human history: Bitcoin. With a market capitalization exceeding $2 trillion, over 100 million users worldwide, and recognition as a household word across diverse cultures, Bitcoin has achieved memetic penetration unmatched by any prior monetary innovation. This chapter argues that understanding Bitcoin requires recognizing it as the first monetary technology designed from inception for memetic propagation—money that spreads not through legal decree or institutional enforcement, but through the viral replication of ideas, images, and narratives.

Jean Baudrillard's theoretical framework, developed across Symbolic Exchange and Death (1976) and elaborated in Simulacra and Simulation (1981), advanced one of the most provocative claims in twentieth-century philosophy: that modern Western societies have progressively replaced reality with systems of signs and symbols that no longer represent anything external to themselves [8.2]. In Baudrillard's framework, we have moved from a world where representations reflected reality, to one where representations mask reality, to one where representations mask the absence of reality, and finally to one where representations bear no relation to reality whatsoever—what he termed the "pure simulacrum" or hyperreality.

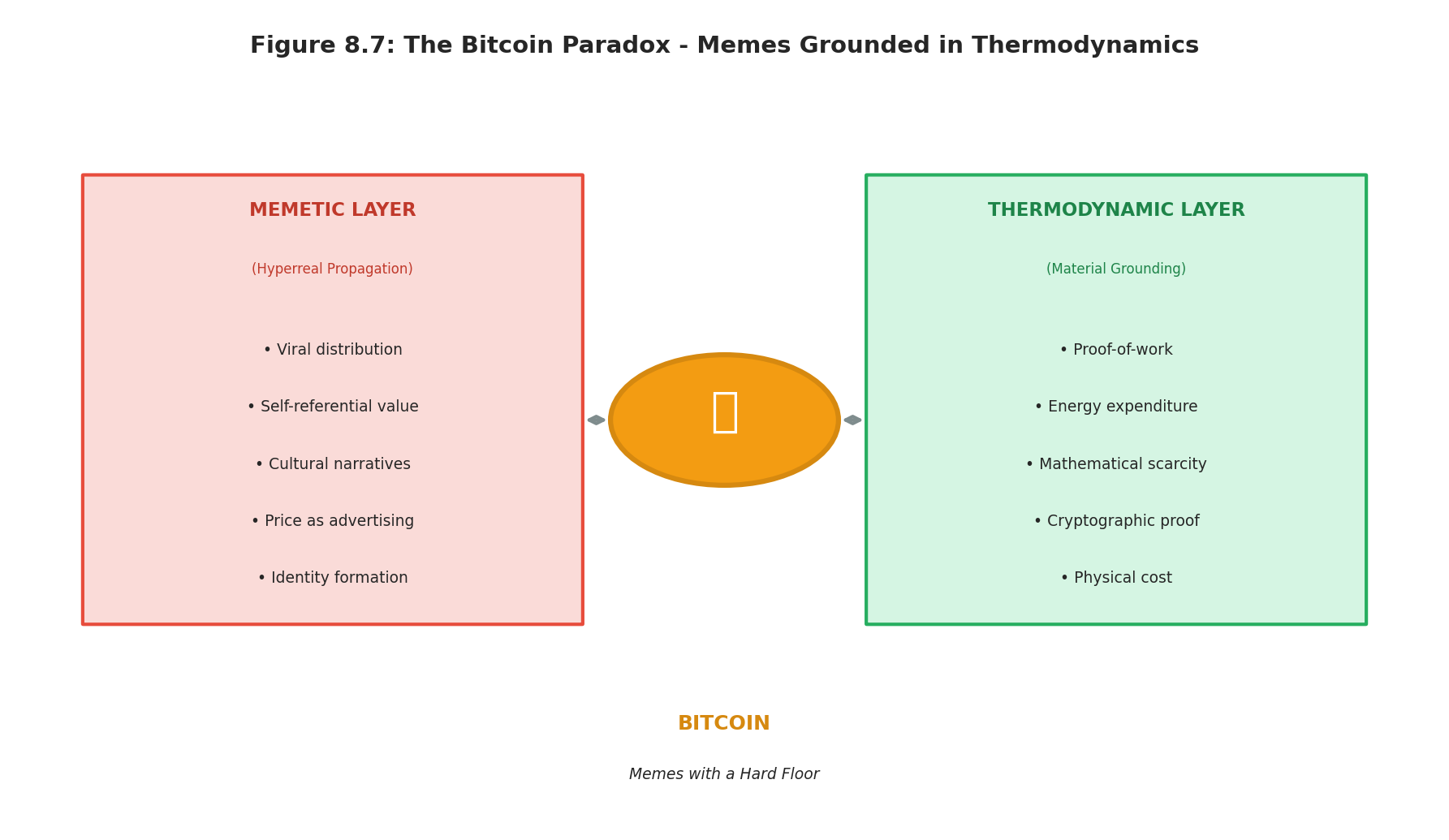

Bitcoin occupies a paradoxical position within this framework. On one hand, it appears to be the ultimate hyperreal money: a digital token that exists purely as cryptographic proof, spreading through viral memes and self-referential cultural narratives. "Digital Gold," "Number Go Up," "HODL," "Have Fun Staying Poor"—these memetic carriers create shared meaning and drive adoption without any reference to physical reality. On the other hand, each Bitcoin unit represents a verifiable expenditure of computational energy, linking the meme to the physical laws of thermodynamics in a way that no previous form of money has achieved. This is not metaphor—it is physical reality encoded in cryptographic proof.

We introduce the concept of "memes with a hard floor"—viral cultural units whose propagation operates in the hyperreal domain while their validity is anchored to irreducible physical constraints. Bitcoin exemplifies this category: its cultural transmission follows memetic dynamics, but its scarcity and security derive from thermodynamic requirements that cannot be circumvented by any intelligence, artificial or human. This chapter develops a comprehensive framework for understanding the memeification of money and its revolutionary implications.

Theoretical Framework: Baudrillard's Orders of Simulacra

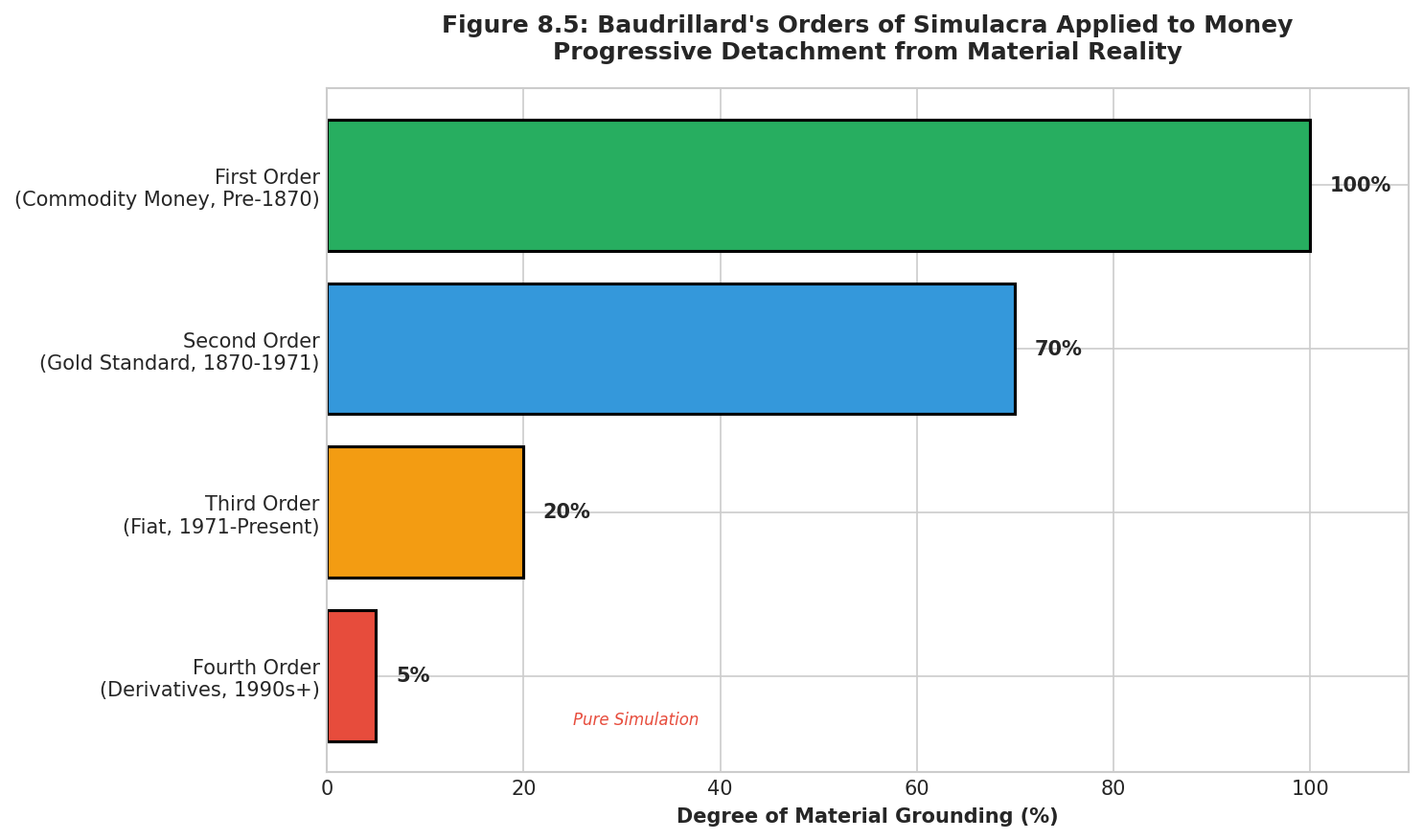

To properly situate Bitcoin's memeification within intellectual history, it is necessary to first elaborate Baudrillard's four successive phases of the image and their corresponding orders of simulacra. Baudrillard initially developed this framework in Symbolic Exchange and Death (1976), later refining it in Simulacra and Simulation (1981). He identified four historical stages in the relationship between signs and reality, each representing a progressive detachment of representation from the represented [8.2].

Table 8.1: Baudrillard's Orders of Simulacra Applied to Monetary Systems

Order | Relation to Reality | Monetary Example | Propagation Mechanism |

First | Reflection of reality | Commodity money (gold, silver) | Market emergence |

Second | Masks/perverts reality | Gold-backed paper currency | Institutional trust |

Third | Masks absence of reality | Fiat currency (post-1971) | Legal tender laws |

Fourth | Pure simulation | Derivatives, algorithmic trading | Self-referential circulation |

Bitcoin | Paradox: simulation + reality | Proof-of-work cryptocurrency | Memetic propagation |

Source: Adapted from Baudrillard [8.2] with monetary applications by author

In the first order, characteristic of pre-industrial societies, the sign is a faithful copy of reality. Commodity money such as gold and silver coins represents this order: the money literally embodies its value through the precious metal content. Money spreads through organic market processes as traders discover that certain commodities serve better as media of exchange. As Graeber documented in his comprehensive history of debt, this period was characterized by a direct material relationship between monetary tokens and economic value [8.3].

The second order emerges with industrialization and mass production, where signs begin to obscure reality while still maintaining a connection to it. Representative money—paper currency redeemable for gold—exemplifies this stage. Money spreads through institutional trust: people accept paper notes because they believe in the issuing bank's promise to redeem them. The gold standard system that prevailed internationally from approximately 1870 to 1914 operated within this second order [8.4].

The third order marks a decisive break: signs now mask the absence of a profound reality. The abandonment of the gold standard—first by the United Kingdom in 1931, then comprehensively by the United States in 1971 with the Nixon Shock—ushered contemporary monetary systems into this third order [8.4]. Fiat currency no longer represents stored gold; it merely performs the function of money through social convention and legal decree. Money spreads through legal tender laws: governments force acceptance through taxation requirements and legal enforcement. The Federal Reserve's balance sheet expansion from approximately $900 billion in 2008 to over $8 trillion by 2022 illustrates the complete detachment of monetary creation from any material constraint [8.5].

The fourth order represents pure simulation: signs relate only to other signs in a closed, self-referential system with no connection to external reality whatsoever. The modern derivatives market, with a notional value exceeding $600 trillion according to Bank for International Settlements data, operates almost entirely within this hyperreal domain [8.6].

Bitcoin breaks this linear progression. It operates through fourth-order memetic propagation—spreading through viral signs, cultural narratives, and self-referential value creation—while simultaneously anchoring itself to first-order material reality through proof-of-work. This is the paradox of memeified money.

The Fiat System: Simulation Without Anchor

Before examining Bitcoin's memetic revolution, it is essential to fully characterize the hyperreal nature of contemporary fiat monetary systems. The post-Bretton Woods international monetary order represents perhaps the purest instantiation of Baudrillard's theoretical predictions outside of media and advertising—simulation without any material anchor.

Contemporary fiat currency exists as a sign with no referent. When the United States abandoned gold convertibility in 1971, the dollar ceased to represent any external reality; it became a pure sign circulating within a closed system of other signs. The dollar's value is determined not by any commodity backing but by its exchange rate against other fiat currencies, themselves equally unanchored to material reality. This creates what Baudrillard termed "the precession of simulacra"—the model precedes and determines the real, rather than the reverse [8.2].

The mechanisms of fiat money creation further illustrate this hyperreal character. Central banks create money through accounting entries—quite literally typing numbers into existence on digital ledgers. Commercial banks multiply this base money through fractional reserve lending, creating additional purchasing power through the simple act of recording loans on balance sheets. The money supply expands and contracts based on confidence, expectations, and policy decisions rather than any change in underlying economic production or resource availability.

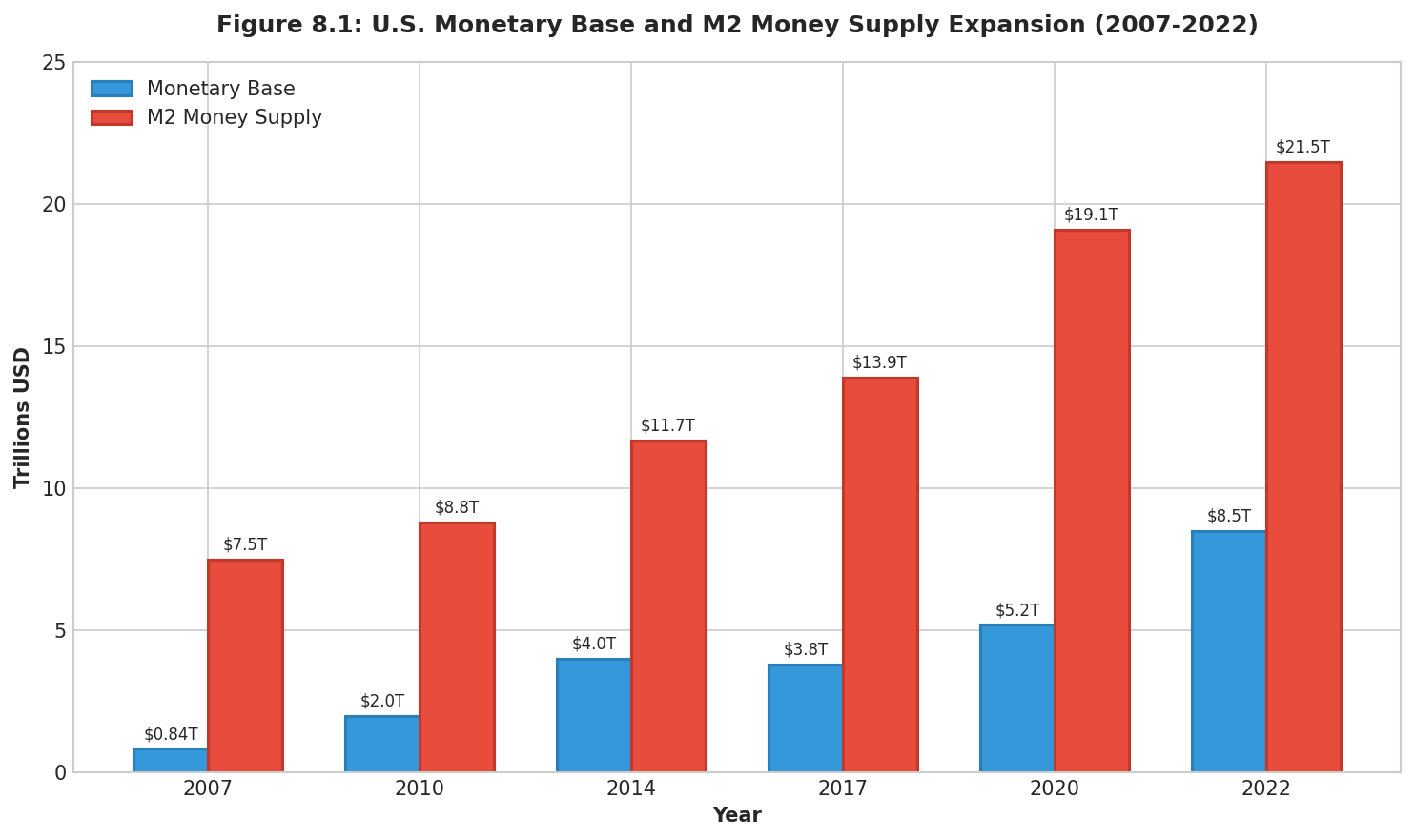

Table 8.2: U.S. Monetary Base Expansion (Selected Years)

Year | Monetary Base (Trillions USD) | M2 Money Supply (Trillions USD) | Expansion Mechanism |

2007 | $0.84 | $7.5 | Pre-crisis baseline |

2014 | $4.0 | $11.7 | QE1, QE2, QE3 |

2020 | $5.2 | $19.1 | COVID-19 response |

2022 | $8.5 | $21.5 | Peak expansion |

Source: Federal Reserve Economic Data [8.5]. Data as of year-end for each period shown.

The data presented in Table 8.2 and Figure 8.2 demonstrates the pure simulacral character of contemporary money creation. The monetary base expanded by approximately 1,000% between 2007 and 2022, an expansion achieved entirely through symbolic operations—accounting entries, policy announcements, and the circulation of signs among financial institutions. No gold was mined, no productive capacity was created, no new resources were discovered. The expansion represents the pure precession of the model over reality. Fiat money is hyperreality without any thermodynamic anchor.

The emergence of artificial intelligence accelerates fiat's hyperreal character to unprecedented extremes. Algorithmic trading systems now execute the majority of equity transactions, operating on timeframes imperceptible to human cognition—microsecond arbitrage across markets that exist as pure mathematical abstraction. AI-driven derivatives create synthetic exposures to assets that may themselves be synthetic, layering simulation upon simulation. High-frequency trading algorithms respond not to economic fundamentals but to patterns in other algorithms' behavior, creating feedback loops entirely divorced from productive reality. The Bank for International Settlements estimates that derivatives markets now exceed $600 trillion in notional value—roughly six times global GDP—representing claims on claims on claims with no necessary connection to underlying economic activity [8.6]. In this environment, fiat currency serves not as a representation of value but as the medium through which simulations interact with other simulations. AI does not merely participate in financial hyperreality; it industrializes it.

Bitcoin: Memes with a Hard Floor

Bitcoin enters this landscape as what initially appears to be the ultimate meme money: a purely digital token with no physical form, no governmental backing, and no connection to any commodity. Satoshi Nakamoto's 2008 white paper described a "purely peer-to-peer version of electronic cash" that would exist only as cryptographic proofs on a distributed network [8.7]. By all surface appearances, Bitcoin should represent the apotheosis of monetary simulation.

Yet Bitcoin contains within its protocol a mechanism that radically distinguishes it from all previous forms of money: proof-of-work. This creates what we term "memes with a hard floor"—viral ideas anchored to thermodynamic reality.

Proof-of-Work: The Thermodynamic Anchor

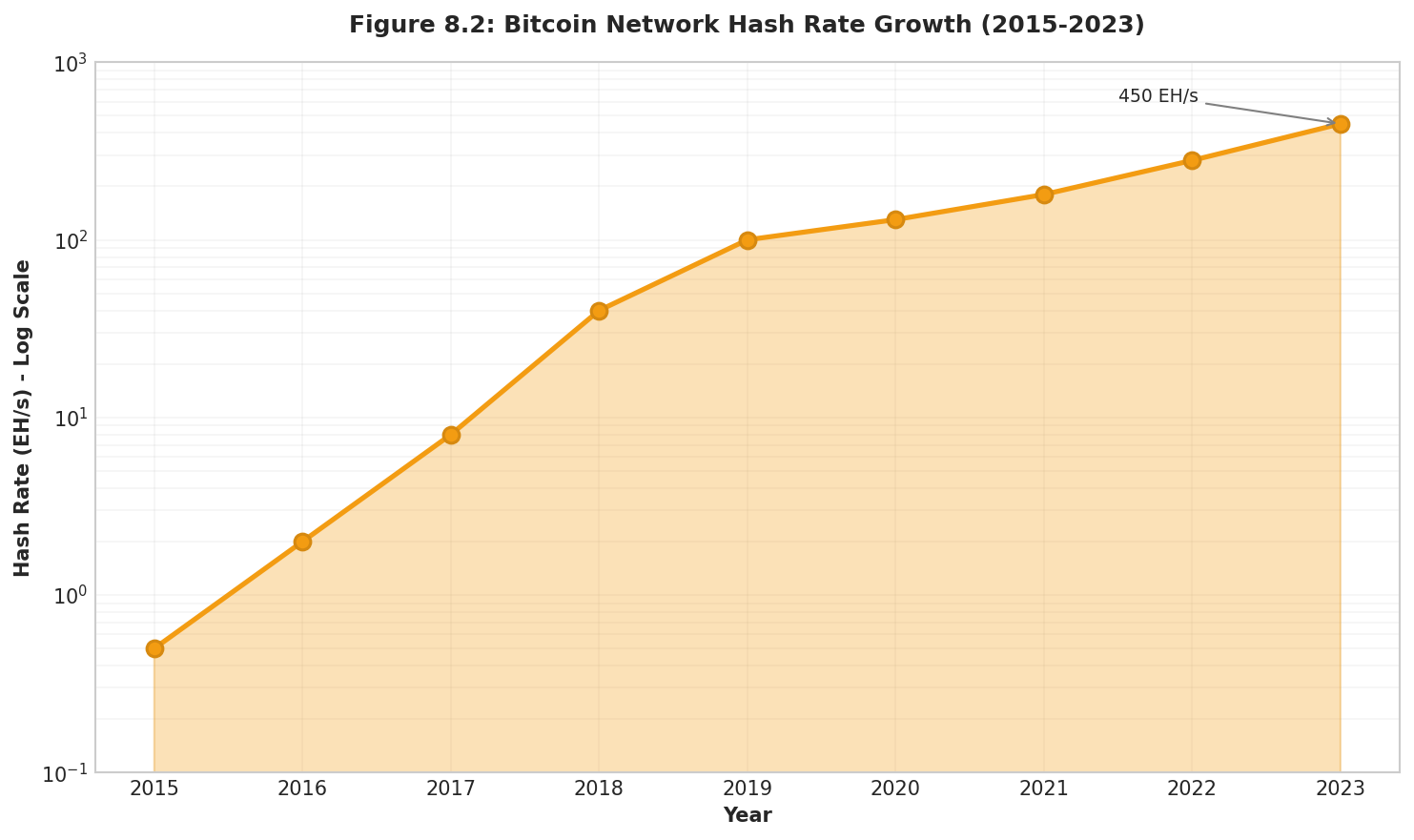

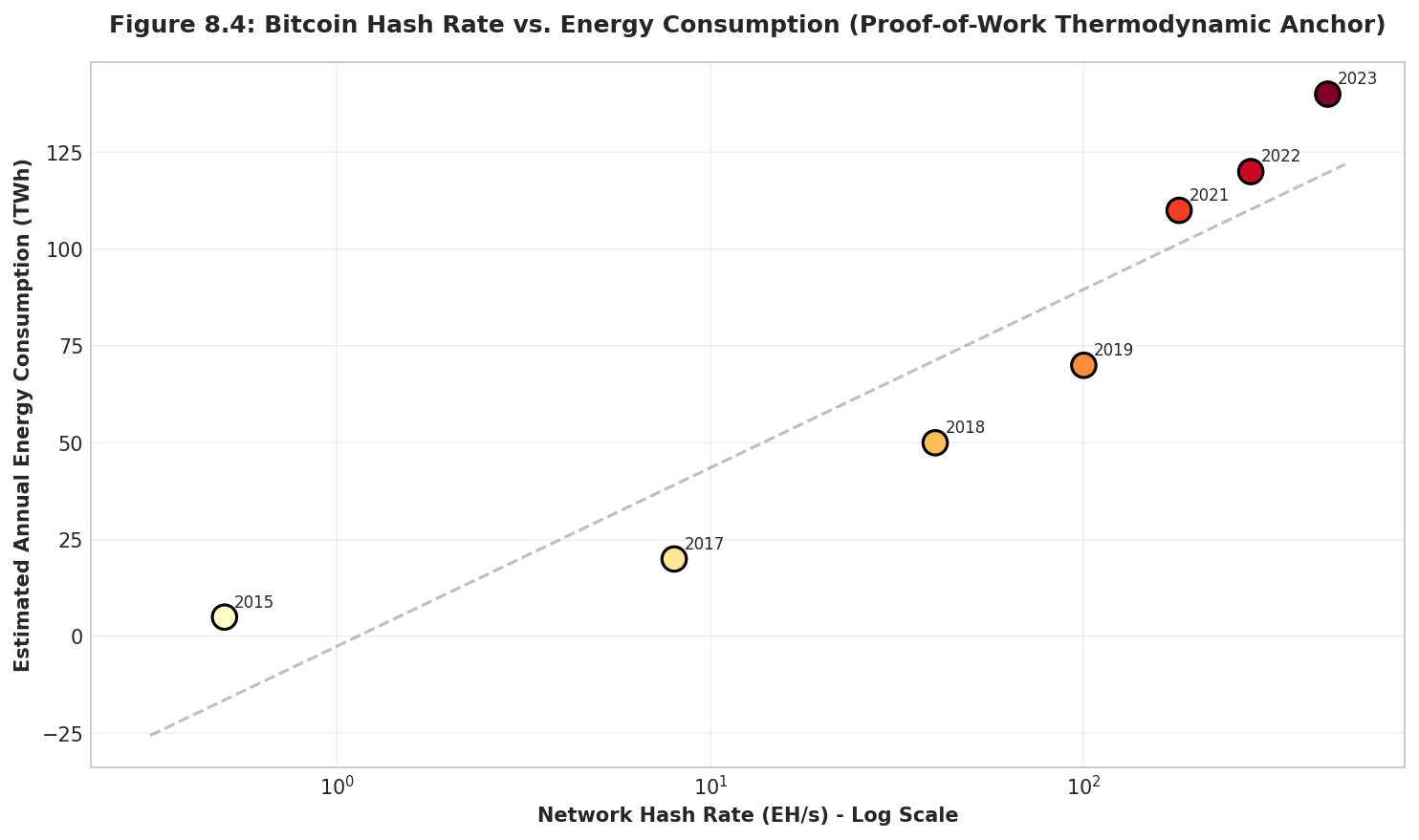

The proof-of-work consensus mechanism requires miners to expend computational resources—and therefore electrical energy—to validate transactions and create new Bitcoin. The SHA-256 hashing algorithm at the core of Bitcoin mining demands approximately 700–800 exahashes per second network-wide as of early 2025, consuming an estimated 120–150 terawatt-hours of electricity annually [8.8].

Table 8.3: Bitcoin Network Energy Consumption and Hash Rate Growth

Year | Network Hash Rate (EH/s) | Est. Annual Energy (TWh) | Energy per BTC Mined |

2015 | 0.5 | ~5 | ~7,500 kWh |

2018 | 40 | ~50 | ~75,000 kWh |

2021 | 180 | ~110 | ~340,000 kWh |

2025 | ~750 | ~140 | ~850,000 kWh |

Source: Cambridge Centre for Alternative Finance [8.8]; Author calculations

This energy expenditure is constitutive of Bitcoin's function, not incidental to it. Each Bitcoin unit represents a provable expenditure of thermodynamic work, linking the digital meme to the physical laws of the universe in a way that no other form of money can claim. As Ammous argued in The Bitcoin Standard, this creates a form of "digital scarcity" that mirrors the natural scarcity of precious metals while transcending their physical limitations [8.9].

The theoretical significance of this observation cannot be overstated. Bitcoin represents a monetary meme that, unlike fiat currency, cannot be created through pure symbolic manipulation. The creation of new Bitcoin requires the physical expenditure of energy, linking the meme to material reality through the laws of thermodynamics. In Baudrillardian terms, Bitcoin is a simulacrum that refers back to the real—a paradox that Baudrillard's framework did not anticipate.

Mathematical Scarcity: The Unforgeable Meme

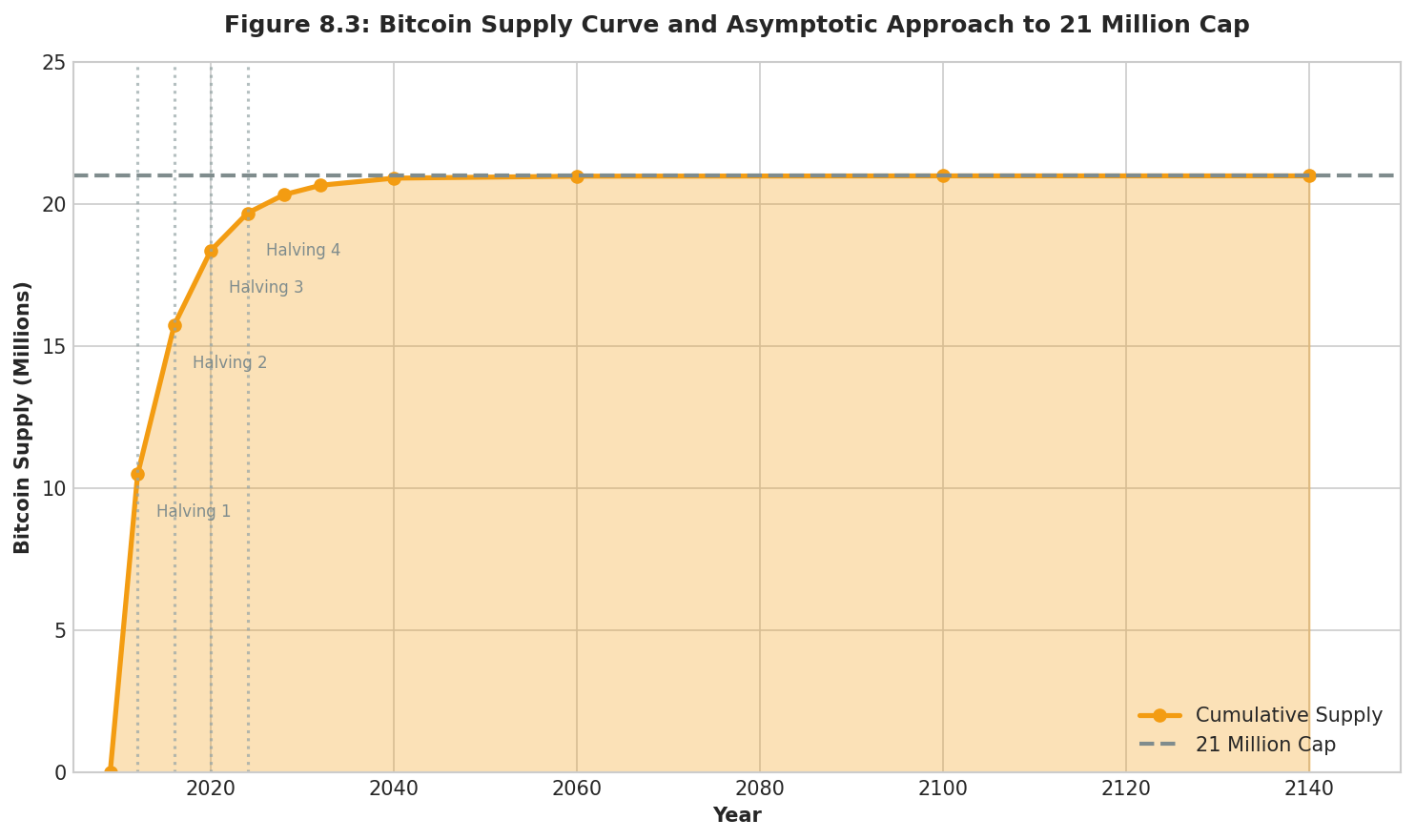

Beyond proof-of-work, Bitcoin incorporates a second mechanism that anchors its memes to a form of reality: absolute mathematical scarcity. The Bitcoin protocol permanently caps total supply at 21 million units, with issuance following a predetermined halving schedule that reduces block rewards approximately every four years. This stands in stark contrast to fiat currencies, which can be created in unlimited quantities at the discretion of monetary authorities.

Table 8.4: Bitcoin Halving Schedule and Supply Dynamics

Halving Event | Year | Block Reward (BTC) | Cumulative Supply | % of Total Supply |

Genesis | 2009 | 50 | 0 | 0% |

First | 2012 | 25 | 10.5M | 50% |

Second | 2016 | 12.5 | 15.75M | 75% |

Third | 2020 | 6.25 | 18.375M | 87.5% |

Fourth | 2024 | 3.125 | 19.69M | 93.75% |

Final | ~2140 | 0 | 21M | 100% |

Source: Bitcoin Protocol Specification

The "21 Million" meme is not empty rhetoric—it is a verifiable mathematical fact embedded in the protocol's consensus rules. Unlike commodity money, whose scarcity is contingent on geological factors and mining technology, Bitcoin's scarcity is absolute and verifiable by any participant running a full node. As Szabo argued in his prescient work on "bit gold," such unforgeable costliness creates a form of value that transcends mere social convention [8.10]. The meme has teeth.

The Memetic Complex: How Bitcoin Spreads

If proof-of-work anchors Bitcoin to physical reality, its propagation mechanism operates entirely within the hyperreal domain. Bitcoin spreads not through legal tender laws or governmental decree, but through memetic transmission—the viral replication of ideas, phrases, and images that create shared meaning and motivate action. This is the memeification of money in its purest form.

Anatomy of the Bitcoin Meme

Bitcoin has developed a sophisticated memetic complex—an interconnected system of phrases, images, and narratives that facilitate its adoption and spread. Each meme serves a specific function in the propagation ecosystem.

Table 8.5: The Bitcoin Memetic Complex

Meme | Semantic Content | Propagation Function |

"Digital Gold" | Bitcoin is a scarce store of value analogous to precious metal. | Leverages existing mental models and reduces cognitive load for new adopters. |

"21 Million" | Bitcoin has an absolute and verifiable supply cap. | Creates urgency through implied scarcity and FOMO dynamics. |

"Number Go Up" | The investment thesis reduces to price appreciation. | Appeals to financial self-interest through viral simplicity. |

"Orange Pill" | Bitcoin adoption represents an awakening or enlightenment. | Creates in-group identity and frames evangelism as service. |

"HODL" | Long-term holding is encouraged regardless of volatility. | Reduces sell pressure and creates behavioral commitment. |

"Have Fun Staying Poor" | Skeptics are dismissed with implied future regret. | Creates social pressure and triggers loss aversion. |

"Laser Eyes" | A visual signifier marks Bitcoin advocacy identity. | Creates visible tribal identity on social media platforms. |

"Fix the Money, Fix the World" | Bitcoin is framed as a solution to systemic problems. | Provides moral justification and attracts idealists. |

Source: Author analysis of Bitcoin social media discourse

These memes operate precisely as Baudrillard described third and fourth-order simulacra: they do not describe a pre-existing reality but rather create the reality they purport to represent. The phrase "digital gold" does not merely describe Bitcoin's properties; it constructs a cognitive framework that shapes how people perceive and value the asset. "Number Go Up" does not merely predict price appreciation; it creates a self-fulfilling prophecy as new buyers, motivated by the meme, drive prices higher, thereby validating the meme and spurring further adoption.

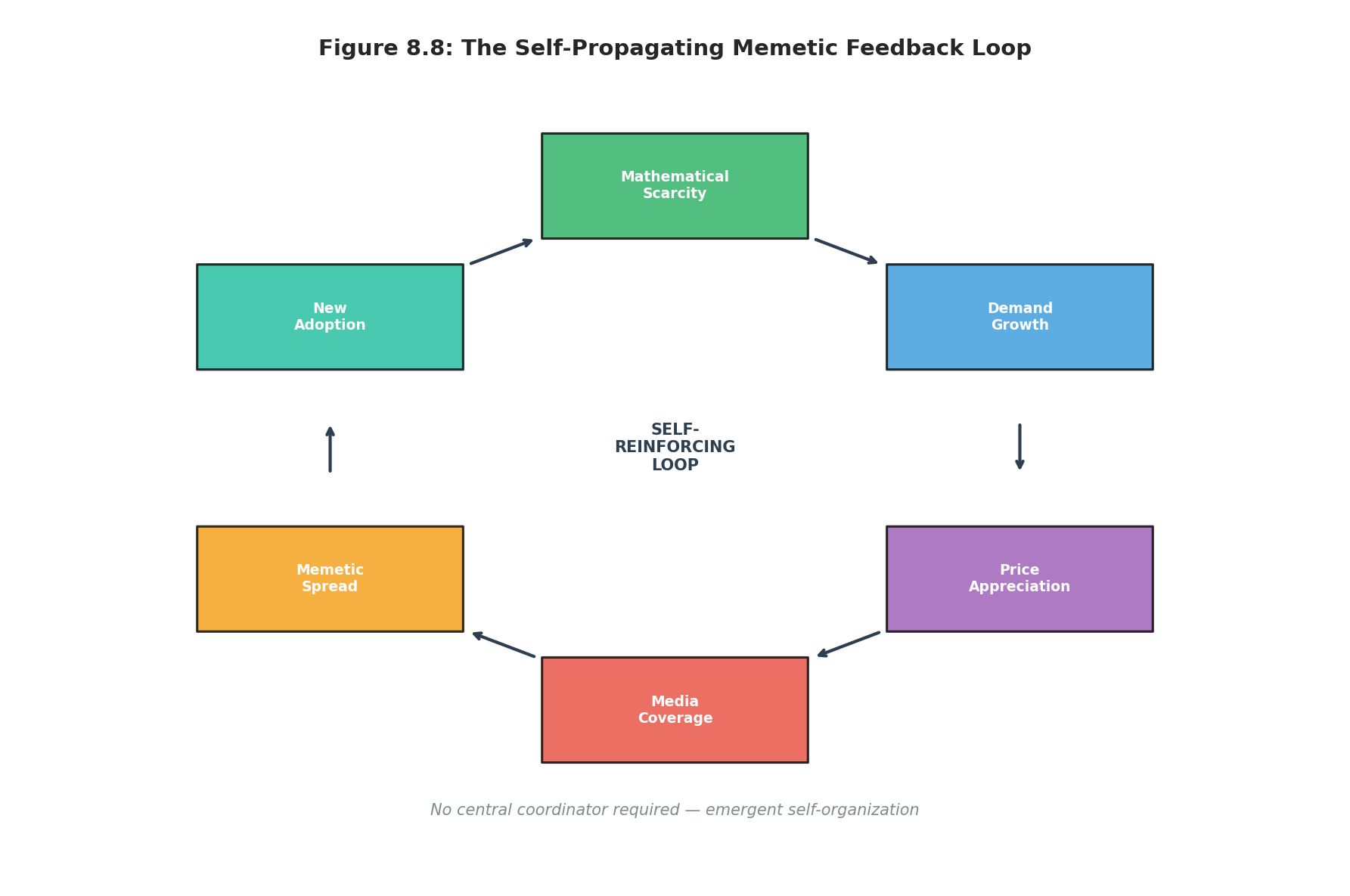

Price as Advertising: The Self-Marketing Money

Baudrillard observed that in consumer capitalism, advertising no longer serves to communicate information about products; rather, it circulates signs that construct desire and identity [8.2]. Bitcoin has achieved something remarkable: it has embedded its advertising mechanism directly into its price dynamics.

Every price increase generates media coverage. Every media mention introduces Bitcoin to new potential adopters. Every new adopter increases demand and price. The logarithmic price chart, displaying exponential growth over time, functions as a global billboard that requires no advertising budget, no marketing agency, no PR campaign. The chart itself is the advertisement, and it writes itself through the aggregated behavior of market participants.

This represents a fundamental inversion of traditional marketing dynamics. Conventional products require advertising expenditure to generate sales. Bitcoin generates "advertising" (price increases and media coverage) as a byproduct of sales (purchases on exchanges). The causality runs in reverse: demand creates its own advertising, which creates more demand, in a self-reinforcing cycle that requires no central coordinator. This is why Bitcoin's critics who dismiss it as "just marketing" miss the point entirely—the marketing IS the product, and the product IS the marketing.

The emergence of artificial intelligence introduces a new dimension to memetic competition. AI systems can generate, target, and propagate memes at scales and speeds impossible for human actors—billions of personalized persuasion attempts per second, each optimized for individual psychological profiles. This represents memetic warfare at machine scale, where synthetic content floods information channels faster than human cognition can evaluate it. In such an environment, memes lacking verifiable foundations become indistinguishable from AI-generated noise. Bitcoin's organic memetic spread—emerging from genuine human conviction rather than algorithmic manufacture—possesses a distinctive property: its core claims can be independently verified. The "21 Million" meme is not rhetoric but mathematics anyone can audit. The hash rate is not an assertion but a physical measurement. This verifiability distinguishes Bitcoin's grounded memes from the synthetic memes that AI can produce without limit. As the information environment becomes saturated with machine-generated content, the ability to anchor memetic claims to independently verifiable reality becomes not merely advantageous but essential for maintaining meaning itself.

The Self-Propagating Memetic System

The preceding analysis reveals Bitcoin as a uniquely self-sustaining monetary technology, combining material grounding through proof-of-work with hyperreal propagation through memetics. This section synthesizes these elements into a comprehensive model of Bitcoin as a self-propagating memetic financial system.

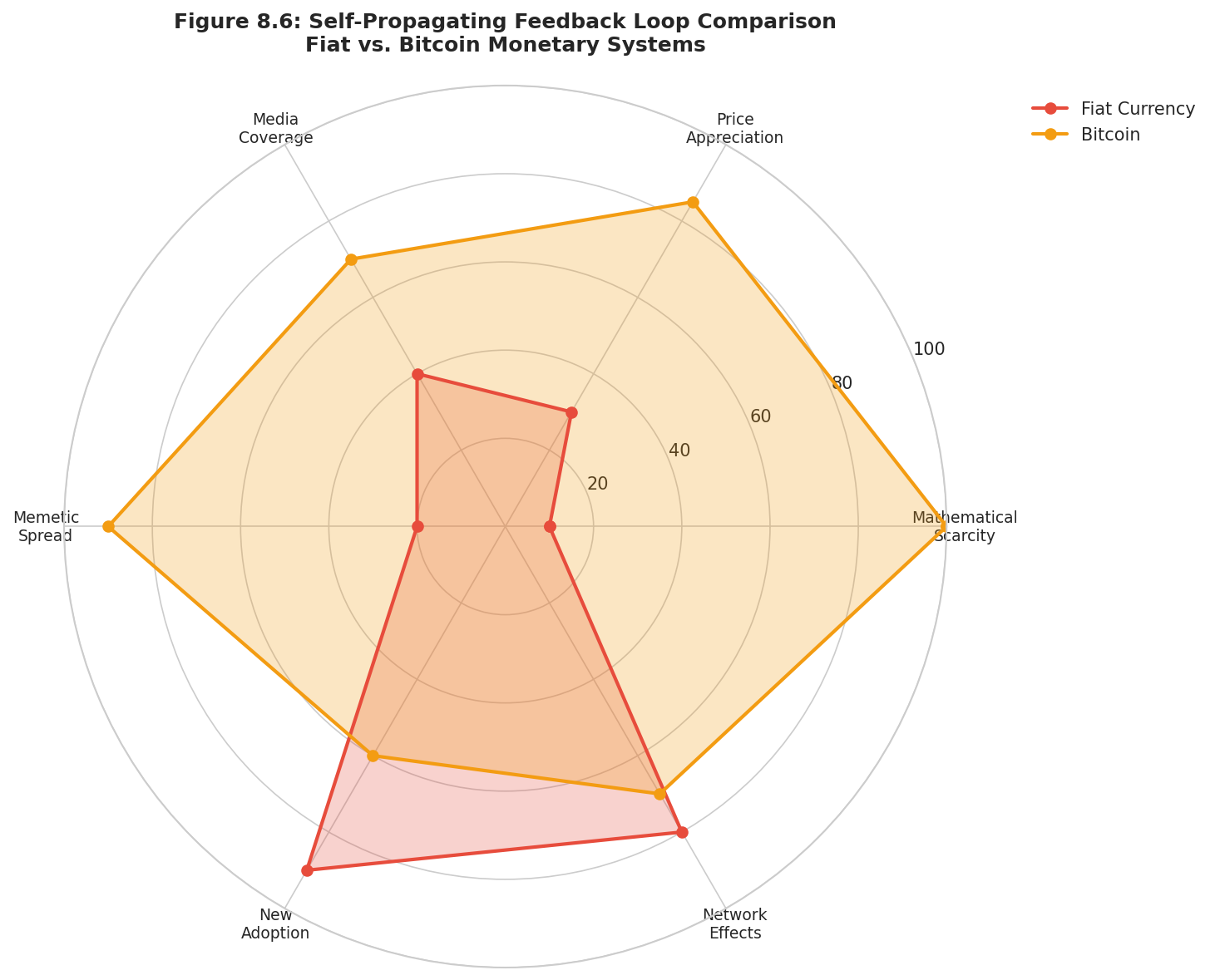

Bitcoin's design incorporates three distinct enforcement mechanisms that together create a closed, self-sustaining loop:

Code Enforcement: The Bitcoin protocol enforces absolute scarcity through deterministic rules embedded in software. The 21 million supply cap and halving schedule cannot be altered without consensus from the network majority, creating what Antonopoulos termed "immutable monetary policy" [8.11]. The meme "21 Million" rests on unforgeable code.

Energy Enforcement: Proof-of-work consensus ensures that monetary creation requires physical resource expenditure. This mechanism links Bitcoin's supply to thermodynamic reality, preventing the pure symbolic creation that characterizes fiat currency. The meme "Digital Gold" derives its validity from real energy expenditure.

Memetic Enforcement: Viral propagation through word of mouth, social media, and price action ensures continuous distribution without centralized marketing. Each new participant becomes a distribution node, evangelizing the network to potential new users. The meme propagates itself through those it converts.

Table 8.6: Comparative Analysis of Monetary System Propagation Mechanisms

Dimension | Commodity Money | Fiat Currency | Bitcoin |

Scarcity Mechanism | Geological | None (discretionary) | Mathematical |

Cost of Production | Mining/extraction | Near zero | Energy (proof-of-work) |

Propagation Mechanism | Market emergence | Legal tender laws | Memetic propagation |

Direction | Organic | Top-down | Bottom-up viral |

Verifiability | Physical assay | Trust in institution | Cryptographic proof |

Baudrillard Order | First | Third/Fourth | First + Fourth Hybrid |

Source: Author analysis

Critically, this loop requires no central coordinator. Unlike fiat currencies, which require ongoing institutional maintenance through central bank operations, legal enforcement, and fiscal policy, Bitcoin's memetic feedback loop operates autonomously through the interaction of market participants, software protocols, and social networks. This represents what complexity theorists would recognize as an emergent, self-organizing system [8.12].

This decentralization carries profound implications for the emerging era of artificial intelligence. Centralized systems—whether monetary authorities, media organizations, or verification infrastructure—present single points of capture for AI systems seeking to manipulate human behavior or economic activity. An AI that gains control over a central bank can manipulate monetary policy; an AI that captures social media algorithms can manufacture consensus; an AI that compromises identity verification can generate unlimited synthetic actors. Bitcoin's architecture presents no equivalent capture point. There is no CEO to influence, no board to infiltrate, no single server to compromise. The protocol propagates through thousands of independent nodes; its rules are enforced by mathematical proof rather than institutional authority; its memetic spread emerges from millions of individual decisions rather than centralized coordination. This is not merely technical resilience but epistemological defense: in a world where AI can simulate any centralized authority, only systems that operate without central authority can resist systematic manipulation. Bitcoin's self-propagating memetic architecture is not merely an interesting property—it may be essential infrastructure for preserving human agency in an age of machine intelligence.

Theoretical Implications: The Memeification Thesis

The analysis presented in this chapter suggests that Bitcoin represents a phenomenon that transcends Baudrillard's theoretical framework even while illuminating its insights. Baudrillard predicted that money would dissolve into pure simulation, losing all connection to material reality. Bitcoin partially confirms this prediction—its propagation mechanism operates entirely within the hyperreal domain of memes, narratives, and self-referential signs. Yet Bitcoin simultaneously refutes the prediction by anchoring its memetic existence to thermodynamic reality through proof-of-work.

This paradox suggests the possibility of what we term "grounded memetics"—systems of viral ideas that operate within the hyperreal domain while maintaining verifiable connections to material reality. Such systems represent a potential resolution to the crisis of meaning that Baudrillard identified in postmodern society. Rather than losing ourselves in pure simulation, grounded memetics offers a path back to the real through technologies that enforce correspondence between memes and physical reality.

A counterargument deserves acknowledgment. Critics such as Sperber have questioned whether memetics provides genuine explanatory power or merely redescribes cultural transmission in biological metaphors [8.13]. The "meme" concept may impose inappropriate evolutionary logic on cultural phenomena that operate through different mechanisms entirely. We accept this critique as partially valid: memetics alone cannot explain Bitcoin's success, which depends equally on its technical properties, economic incentives, and historical context. However, as a heuristic framework for understanding how monetary technologies propagate through populations, memetic analysis illuminates dynamics that traditional economic models neglect. The framework's utility lies not in its completeness but in its capacity to reveal mechanisms of cultural transmission that shape adoption trajectories.

The implications for monetary theory are significant. The traditional dichotomy between commodity money (anchored to material reality) and fiat money (pure social convention) may be inadequate to capture the full range of monetary possibilities. Bitcoin suggests a third category: memeified money—cryptographically-enforced digital scarcity that combines the portability and divisibility of fiat with the hard supply constraints of commodities, propagated through memetic mechanisms that operate independently of governmental authority.

The Future of Memetic Money

This chapter has examined Bitcoin through the theoretical lens of Baudrillard's simulacra and Dawkins's memetics, revealing a profound paradox at the heart of this novel monetary technology. Bitcoin is simultaneously the most memetic form of money ever created—a digital virus that spreads through viral propagation, cultural narratives, and self-referential signs—and the most materially grounded currency since the gold standard, with each unit representing verifiable energy expenditure governed by the laws of thermodynamics.

The memeification of money represents both the proof and the cure for Baudrillard's diagnosis. Bitcoin demonstrates that monetary systems can indeed operate primarily through memetic propagation and symbolic exchange. Yet it also demonstrates that such viral systems can be designed to maintain correspondence with material reality through cryptographic and thermodynamic constraints. This is money that spreads like a meme but weighs like gold—hyperreality with a hard floor, simulation tethered to physics, memes grounded in mathematics.

Whether Bitcoin ultimately succeeds as a global monetary standard remains an empirical question that cannot be resolved through theoretical analysis alone. What this analysis demonstrates is that Bitcoin represents a genuinely novel synthesis in the history of money: the first memeified currency that cannot be counterfeited, printed, or conjured. Whatever its ultimate fate, Bitcoin has revealed possibilities for monetary design that neither Baudrillard nor traditional monetary economists anticipated. The memes have learned to anchor themselves to reality.

This synthesis carries profound implications for the broader thesis of this book. As artificial intelligence systems achieve and surpass human cognitive capabilities, the verification mechanisms upon which societies depend face unprecedented challenges. Traditional authentication—identity documents, reputation systems, institutional trust—rests on assumptions about the cost of intelligent action that AI invalidates. Proof-of-work provides a verification mechanism immune to cognitive superiority: no level of intelligence can reduce the thermodynamic cost of producing valid cryptographic proofs. In a world where AI can generate unlimited synthetic content, forge any digital signature, and simulate any identity, Bitcoin's energy-anchored memes may prove essential infrastructure for distinguishing truth from simulation. The memeification of money is not merely a cultural phenomenon but potentially a necessary adaptation for civilization's survival in an era of artificial superintelligence.

References

[8.1] Dawkins, R. (1976). The Selfish Gene. Oxford: Oxford University Press.

[8.2] Baudrillard, J. (1981/1994). Simulacra and Simulation (S. F. Glaser, Trans.). Ann Arbor: University of Michigan Press. See also Baudrillard, J. (1976). Symbolic Exchange and Death. Paris: Gallimard.

[8.3] Graeber, D. (2011). Debt: The First 5,000 Years. Brooklyn, NY: Melville House.

[8.4] Eichengreen, B. (2008). Globalizing Capital: A History of the International Monetary System (2nd ed.). Princeton, NJ: Princeton University Press.

[8.5] Federal Reserve Economic Data. (2023). Monetary Base; M2 Money Stock. St. Louis: Federal Reserve Bank of St. Louis.

[8.6] Bank for International Settlements. (2023). OTC derivatives statistics at end-December 2022. Basel: BIS.

[8.7] Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. Retrieved from https://bitcoin.org/bitcoin.pdf

[8.8] Cambridge Centre for Alternative Finance. (2025). Cambridge Bitcoin Electricity Consumption Index. Retrieved from https://ccaf.io/cbeci

[8.9] Ammous, S. (2018). The Bitcoin Standard: The Decentralized Alternative to Central Banking. Hoboken, NJ: Wiley.

[8.10] Szabo, N. (2002, revised 2005). Shelling Out: The Origins of Money. Retrieved from https://nakamotoinstitute.org/shelling-out/

[8.11] Antonopoulos, A. M. (2017). Mastering Bitcoin: Programming the Open Blockchain (2nd ed.). Sebastopol, CA: O'Reilly Media.

[8.12] Kauffman, S. A. (1995). At Home in the Universe: The Search for the Laws of Self-Organization and Complexity. New York: Oxford University Press.

[8.13] Sperber, D. (1996). Explaining Culture: A Naturalistic Approach. Oxford: Blackwell. See especially Chapter 5 on the epidemiology of representations as critique of memetics.

Page

Coming Soon

This chapter will be available soon.