Part 2: VALUATION · Chapter 6

A First-Principles Based Valuation Framework for Bitcoin

Introduction

The question of Bitcoin's ultimate valuation represents one of the most consequential analytical challenges in contemporary finance. Unlike traditional assets that can be valued through discounted cash flow analysis or comparable transactions, Bitcoin produces no cash flows and has no direct comparables that have achieved similar scale. This fundamental challenge has led to a proliferation of valuation methodologies, ranging from production cost models to network value analyses to the store-of-value framework presented in this chapter.

The store-of-value approach begins with a simple observation: much of global wealth is held not for productive purposes but for preservation. We define the store-of-value premium as the difference between an asset's market price and its fundamental use value. Government bonds, cash holdings, gold, and significant portions of real estate and equity markets function primarily as repositories of value rather than generators of utility or income. These assets carry this store-of-value premium—the portion of their market value attributable to their role in wealth preservation rather than their fundamental use value.

Bitcoin's proposition is straightforward: it offers superior store-of-value characteristics—absolute scarcity, digital portability, censorship resistance, and programmable custody—compared to traditional alternatives. If this proposition gains broader acceptance, capital currently serving store-of-value functions in traditional assets may migrate to Bitcoin. The magnitude of this potential migration, combined with Bitcoin's fixed supply, determines its long-term valuation.

This chapter extends traditional store-of-value analysis by incorporating two critical dimensions often overlooked in mainstream valuation frameworks. First, we integrate the ZeroPoint thesis—the theoretical framework positing that Bitcoin represents money's ground state, the configuration of minimum monetary entropy where money achieves zero supply elasticity, zero counterparty risk, and zero permission requirements. This original theoretical contribution, developed throughout this volume, positions Bitcoin as the only monetary asset capable of approaching this optimal state. Second, we incorporate demand from artificial intelligence systems operating as autonomous economic actors—a category that may represent a substantial component of Bitcoin's long-term valuation [6.11].

For theoretical background on the time value of money under deflationary conditions and how Bitcoin's fixed supply accommodates technological deflation, see Chapter 4.

Theoretical Framework: Store of Value and the ZeroPoint Thesis

The Three Functions of Money

Classical monetary theory identifies three primary functions of money: medium of exchange, unit of account, and store of value [6.1, 6.2]. While considerable attention in Bitcoin analysis has focused on its potential as a medium of exchange, the store-of-value function may be more immediately relevant for valuation purposes.

As Ammous (2018) argues in The Bitcoin Standard [6.3], the store-of-value function historically precedes the medium-of-exchange function in monetary evolution. Assets first gain acceptance as reliable wealth repositories before achieving sufficient liquidity and stability to serve as transaction media. Gold's five-thousand-year monetary history exemplifies this pattern: its scarcity and durability established it as a store of value long before standardized coinage enabled its use in daily commerce.

The store-of-value function is particularly relevant in the current macroeconomic environment. Since the abandonment of the Bretton Woods system in 1971, global monetary aggregates have expanded dramatically, with central bank balance sheets growing from under $1 trillion to approximately $28 trillion following the 2020 pandemic response. This expansion has driven investors toward real assets—real estate, equities, commodities, and collectibles—as protection against currency debasement, embedding significant store-of-value premiums in asset classes not originally designed for this purpose.

The ZeroPoint Thesis: Money as Economic Ground State

The ZeroPoint thesis posits that Bitcoin represents the discovery of money's ground state—the configuration of minimum monetary entropy toward which monetary systems under competitive pressure should naturally converge. Just as physical systems tend toward their lowest energy configuration, monetary systems facing competition should evolve toward the asset that minimizes value leakage across time.

Bitcoin achieves 'zero' across multiple critical dimensions:

• Zero supply elasticity (fixed 21 million cap)

• Zero counterparty risk (bearer instrument requiring no trusted third party)

• Zero monetary entropy (no dilution of existing units)

• Zero permission requirements (permissionless global access)

No prior monetary system has achieved zero across all these dimensions simultaneously.

The ZeroPoint thesis has profound implications for valuation. If Bitcoin represents the thermodynamic optimum for value storage, then rational capital allocation—given sufficient time and information—should flow toward this optimum. The question becomes not whether capital will migrate, but how quickly and completely the transition will occur.

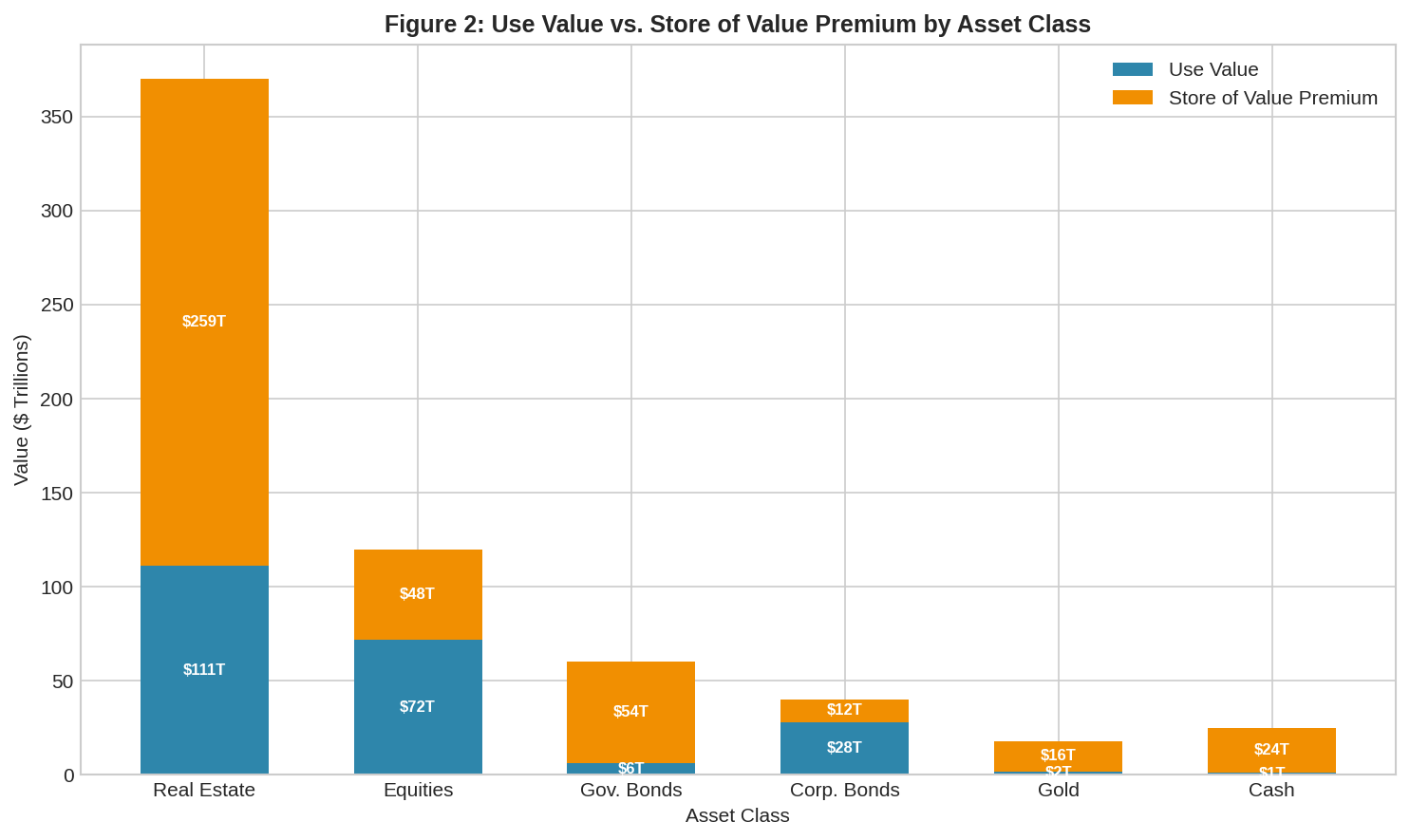

Analytical Implications of the Store-of-Value Premium

The store-of-value premium framework, introduced in Section 6.1, allows us to partition global wealth into two components: (1) use value, representing genuine productive capacity, consumption utility, and fundamental worth, and (2) store-of-value premium, representing the additional value attributed to wealth preservation properties. Bitcoin's addressable market is not global wealth itself but rather the aggregate store-of-value premium embedded across all asset classes.

The distinction matters because it suggests Bitcoin's rise need not come at the expense of productive capacity. If Bitcoin absorbs store-of-value demand currently distorting real estate markets, housing becomes more affordable for those seeking shelter rather than appreciation. If it absorbs monetary premium from equities, stock valuations realign with fundamental earnings power. This great repricing would represent not economic destruction but economic clarification—assets returning to valuations based on use value rather than monetary premium.

Global Wealth Distribution: A Comprehensive Assessment

Accurate estimation of global wealth provides the foundation for store-of-value analysis. We synthesize data from multiple sources—Credit Suisse Global Wealth Reports [6.4], McKinsey Global Institute research [6.5], World Bank statistics, and specialized industry databases—to construct a comprehensive picture of global asset allocation.

Asset Class Overview

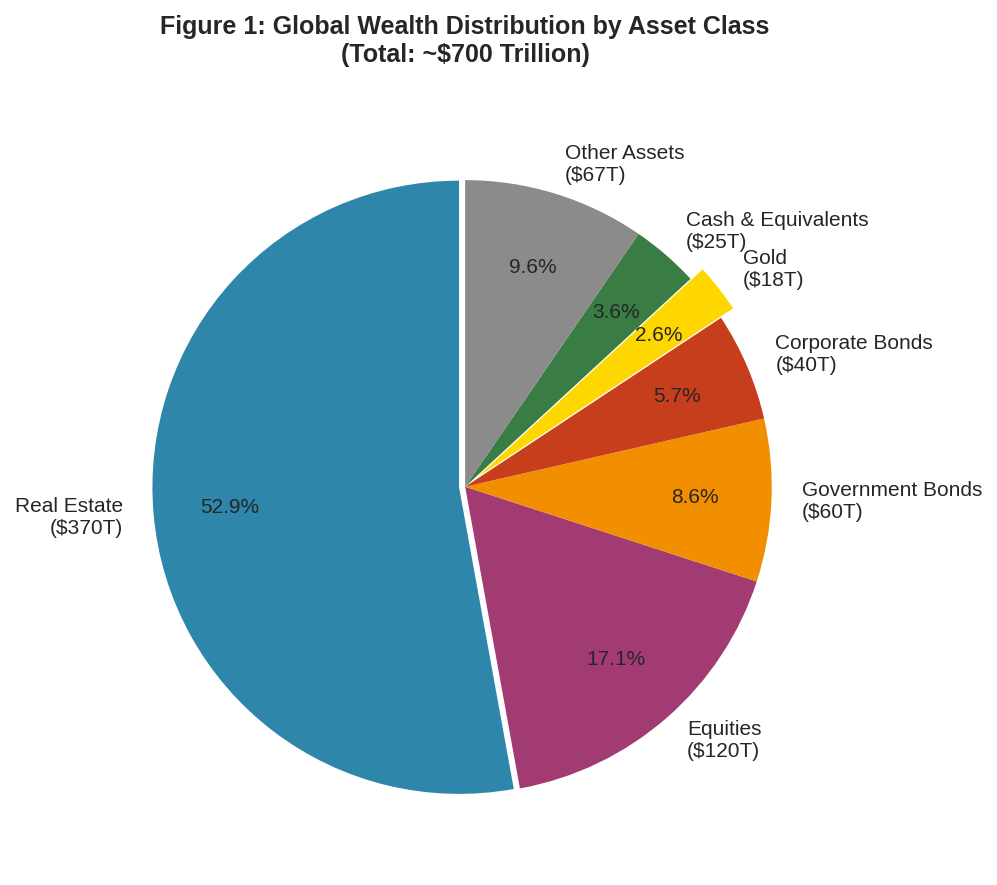

Table 6.1 presents our estimates of global wealth distribution across major asset classes as of 2024. Total global wealth is estimated at approximately $700 trillion, though estimates vary depending on methodology and data sources. Real estate represents the largest single category, followed by financial assets including equities and bonds.

Table 6.1: Global Wealth Distribution by Asset Class (2024 Estimates)

Asset Class | Estimated Value | % of Total | Primary Holders |

Real Estate (Residential) | $250 trillion | 35.7% | Households, Investors |

Real Estate (Commercial) | $120 trillion | 17.1% | REITs, Institutions |

Public Equities | $120 trillion | 17.1% | Pension Funds, Retail |

Government Bonds | $60 trillion | 8.6% | Central Banks, Sovereigns |

Corporate Bonds | $40 trillion | 5.7% | Insurance, Pensions |

Cash and Equivalents | $25 trillion | 3.6% | Banks, Households |

Gold | $18 trillion | 2.6% | Central Banks, Investors |

Private Equity | $15 trillion | 2.1% | Institutions, HNWI |

Art and Collectibles | $12 trillion | 1.7% | HNWI, Collectors |

Cryptocurrency (Total) | $3 trillion | 0.4% | Retail, Institutions |

Other Assets | $37 trillion | 5.3% | Various |

Total | $700 trillion | 100.0% | — |

Notes: Estimates compiled from multiple sources. Cryptocurrency values as of Q4 2024.

Sources: Credit Suisse Global Wealth Report 2024 [6.4]; McKinsey Global Institute 2021 [6.5]; World Gold Council [6.12].

Real Estate: The Dominant Asset Class

Real estate's position as the world's largest asset class reflects both its genuine utility—providing shelter and productive space—and its role as a wealth preservation vehicle. The McKinsey Global Institute estimates that approximately 67% of global wealth is held in real property, with residential real estate alone exceeding $250 trillion [6.5].

However, real estate's store-of-value function has grown substantially since 1971. The financialization of housing, expansion of mortgage markets, and use of property as an inflation hedge have embedded significant monetary premium in real estate valuations, particularly in major metropolitan areas. Analysis of price-to-rent ratios, price-to-income ratios, and construction cost comparisons suggests that in financialized markets, 50–70% of property values may reflect store-of-value demand rather than shelter utility.

Financial Assets

Public equity markets globally exceed $100 trillion in capitalization, with the United States alone accounting for approximately 60% of global market value. While equities fundamentally represent claims on corporate earnings, significant portions are held not for dividend income or capital allocation efficiency but as passive inflation hedges. The growth of index investing has amplified this dynamic, with capital flowing to markets as stores of value rather than as considered investments in productive enterprises.

Government bonds, totaling approximately $60 trillion globally, represent perhaps the clearest example of store-of-value functionality. Sovereign debt, particularly from developed nations, trades at yields that often fail to compensate for inflation, suggesting investors accept negative real returns for the perceived safety and liquidity these instruments provide. The concept of 'flight to quality' during market stress explicitly recognizes bonds' store-of-value function.

Methodology: Estimating Store-of-Value Premiums

Estimating the store-of-value premium embedded in each asset class requires combining quantitative analysis with qualitative judgment. We employ multiple approaches depending on asset characteristics and data availability.

Real Estate Premium Estimation

For real estate, we compare market values against replacement cost (construction cost plus land at non-speculative agricultural values) and imputed rent capitalization. In non-financialized markets, residential property typically trades at 1.0–1.5x replacement cost. In major financial centers—New York, London, Hong Kong, Sydney—multiples of 3–5x are common, suggesting 50–70% of value represents store-of-value premium.

We apply a blended global estimate of 70% store-of-value premium to real estate, weighted toward higher premiums in urban centers where most value is concentrated. This yields approximately $259 trillion in real estate serving primarily as wealth preservation rather than shelter provision.

Financial Asset Premium Estimation

For equities, we estimate store-of-value premium by comparing current valuations to historical fundamental-driven ranges. The Shiller CAPE ratio for U.S. equities has averaged approximately 17x over its history; current levels near 30x suggest roughly 40% of valuation reflects monetary premium rather than earnings expectations. We apply this estimate globally with adjustments for regional variations.

For government bonds trading at negative real yields, we attribute nearly all value (90%) to store-of-value functionality—investors explicitly accept guaranteed purchasing power loss for safety and liquidity. Corporate bonds receive a lower estimate (30%) reflecting genuine credit return expectations.

Gold and Cash

Gold represents an edge case: its industrial and jewelry applications account for approximately 10% of annual demand, suggesting 90% of accumulated gold stock serves monetary functions [6.9, 6.12]. As Szabo (2002) documented in his analysis of money's origins, gold's monetary premium emerged from its unique combination of durability, divisibility, and scarcity—properties that made it optimal for storing value across time [6.9]. We attribute 90% of gold's $18 trillion market value—approximately $16 trillion—to store-of-value premium.

Cash and cash equivalents exist primarily for store-of-value and liquidity purposes. We attribute 95% of cash holdings to these functions, recognizing minimal alternative utility for currency balances beyond transaction facilitation.

Table 6.2: Store-of-Value Premium Estimates by Asset Class

Asset Class | Total Value | SoV Premium % | SoV Premium ($T) | Use Value ($T) |

Real Estate | $370T | 70% | $259T | $111T |

Public Equities | $120T | 40% | $48T | $72T |

Government Bonds | $60T | 90% | $54T | $6T |

Corporate Bonds | $40T | 30% | $12T | $28T |

Gold | $18T | 90% | $16.2T | $1.8T |

Cash/Equivalents | $25T | 95% | $23.75T | $1.25T |

Total (Major Classes) | $633T | 65% | $413T | $220T |

Notes: SoV = Store of Value. Major classes total $633T; the remaining $67T (Private Equity, Art/Collectibles, Cryptocurrency, Other) is excluded from this analysis due to difficulty in disaggregating store-of-value premiums for these heterogeneous categories. Estimates represent author calculations based on methodology described in text; actual premiums will vary by geography, market conditions, and measurement approach.

The preceding analysis establishes that approximately $413 trillion in store-of-value premiums exist across major asset classes—this represents Bitcoin's addressable market. The following section develops valuation scenarios based on varying assumptions about Bitcoin's capture of this market, incorporating both human capital flows and the novel demand category of AI-driven accumulation.

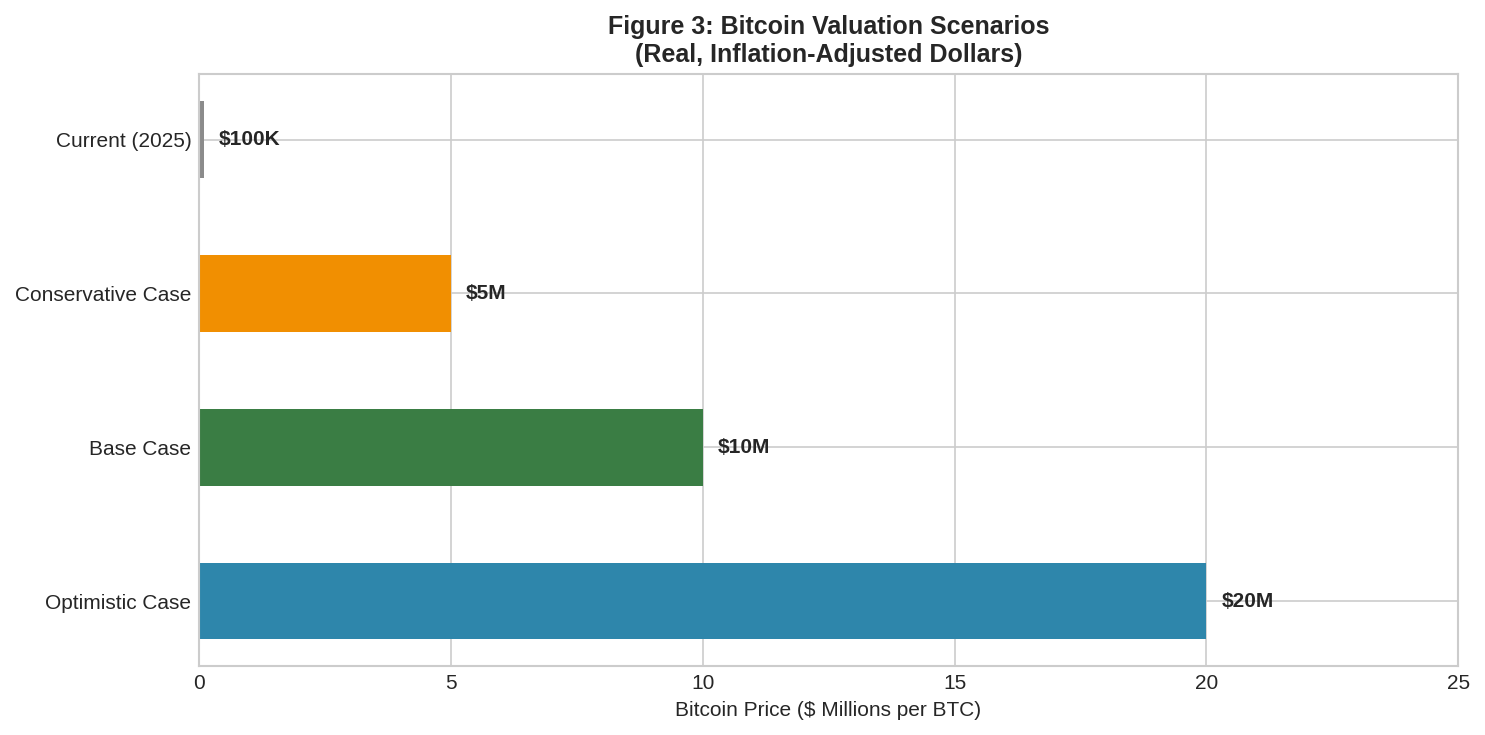

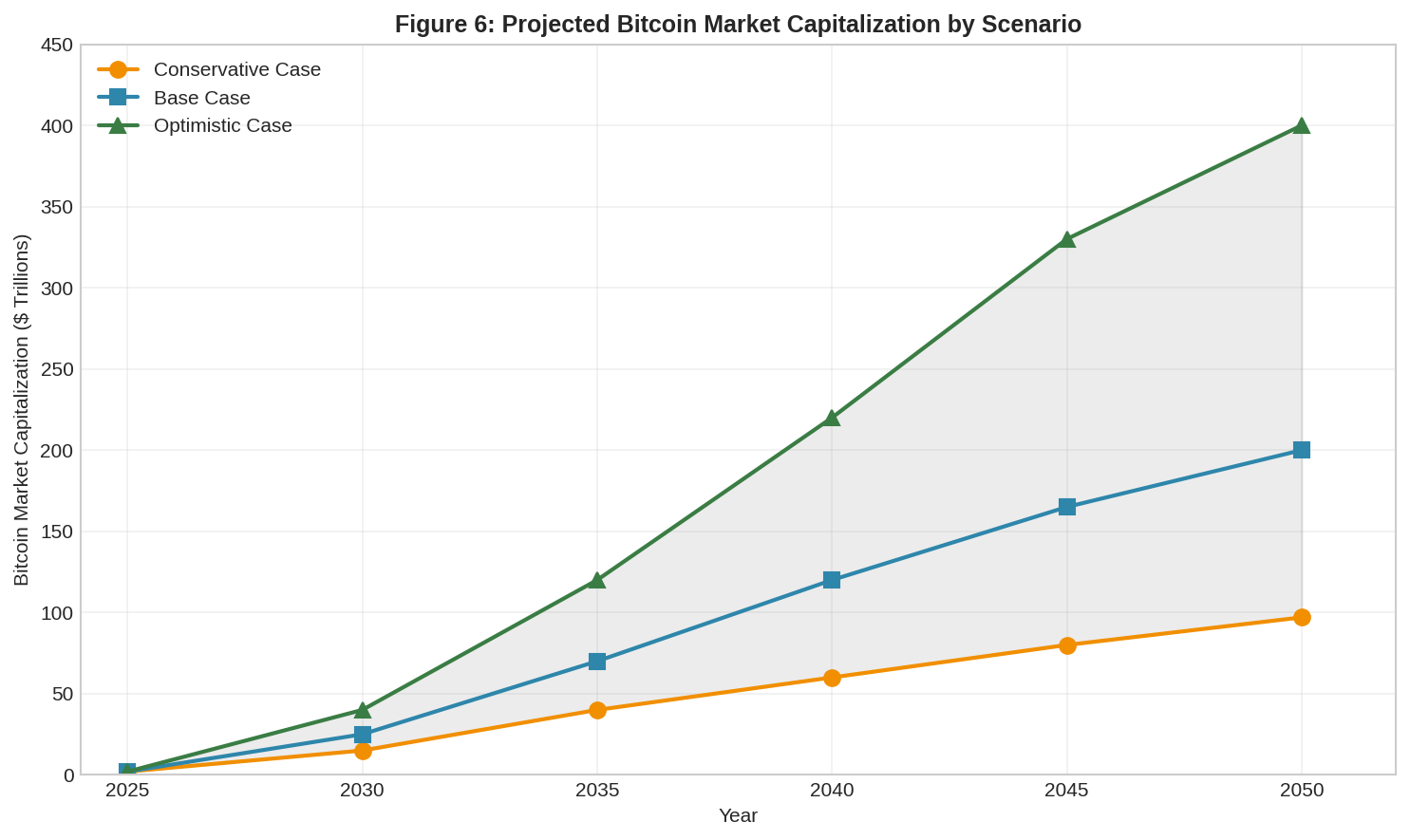

Bitcoin Valuation Scenarios

With store-of-value premium estimates established, we can construct Bitcoin valuation scenarios based on varying assumptions about market share capture. We present three scenarios—Conservative, Base, and Optimistic—reflecting different adoption paths and competitive dynamics. Critically, we augment traditional human-capital flows with projections for AI-driven demand.

Key Assumptions

All scenarios share common assumptions regarding Bitcoin's effective supply. While the protocol caps total supply at 21 million BTC, blockchain analytics research suggests approximately 3–4 million coins are permanently lost due to early adopter negligence, lost private keys, and the presumed loss of Satoshi Nakamoto's holdings [6.14]. We assume an effective circulating supply of 19 million BTC for valuation purposes.

We express all valuations in real (inflation-adjusted) dollars to facilitate comparison across time horizons. Nominal valuations would be higher depending on realized inflation over the adoption period.

The AI Demand Factor: Machine Economies

A critical innovation in our valuation framework is the explicit incorporation of AI-driven demand. As artificial intelligence systems evolve from tools to autonomous economic actors, they will require monetary infrastructure compatible with machine-scale participation [6.11]. Traditional financial systems assume human participants with legal personhood, verifiable identities, and physical presence—characteristics that AI agents do not possess.

Bitcoin's permissionless architecture uniquely accommodates machine economic participation. Any entity capable of generating a valid cryptographic key pair—human or artificial—can participate in the Bitcoin network without identity verification or institutional relationships. This property positions Bitcoin as the natural monetary medium for machine-to-machine transactions, autonomous agent coordination, and AI-mediated economic activity.

We project that machine economies—self-organizing systems of AI agents engaging in resource allocation, service provision, and value exchange—could represent 40–60% of global economic activity by 2040 [6.11, 6.13]. This projection extrapolates from current AI capability growth trajectories and remains inherently speculative; readers should apply appropriate uncertainty discounts. If Bitcoin captures the majority of machine-to-machine transactions due to its superior properties, AI-held Bitcoin could exceed 10 million BTC by 2040—nearly half the effective supply. This demand category is entirely absent from mainstream valuation frameworks.

Conservative Case: Partial Adoption

The Conservative Case assumes Bitcoin achieves significant but not dominant store-of-value status, capturing approximately $97 trillion of the available store-of-value premium from human capital flows. Under this scenario, Bitcoin fully displaces gold's monetary role ($16 trillion), captures 10% of real estate's store-of-value premium ($26 trillion), 10% of equity premium ($5 trillion), 50% of government bond premium ($27 trillion), and 90% of cash holdings ($21 trillion).

Adding conservative AI demand of approximately 2 million BTC ($10 trillion equivalent at terminal valuation) brings total Conservative Case market capitalization to approximately $107 trillion, implying approximately $5.6 million per Bitcoin in real terms.

Base Case: Primary Store of Value

The Base Case assumes Bitcoin becomes the primary global store of value, capturing approximately $200 trillion from human capital flows—roughly 48% of total store-of-value premium across asset classes. This scenario envisions Bitcoin absorbing gold completely, capturing 30% of real estate premium, 25% of equity premium, 75% of government bond premium, and substantially all cash holdings.

Incorporating base case AI demand of approximately 8 million BTC ($80 trillion equivalent) brings total market capitalization to approximately $280 trillion, implying approximately $14.7 million per Bitcoin in real terms.

Optimistic Case: Dominant Monetary Standard

The Optimistic Case envisions Bitcoin achieving near-complete dominance of store-of-value functions globally—a true 'Bitcoin standard' in which the protocol serves as the foundation of a new monetary system. Under this scenario, human capital flows contribute $400 trillion or more.

Adding optimistic AI demand projections—where Bitcoin becomes the dominant settlement layer for machine economies and AI agents hold substantial reserves—could push total market capitalization beyond $500 trillion. This scenario implies approximately $26 million per Bitcoin in real terms.

Table 6.3: Bitcoin Valuation Scenario Summary (Including AI Demand)

Scenario | Human SoV Capture | AI Demand | Total Market Cap | Price/BTC (Real) |

Conservative | $97T | $10T | $107T | $5.6M |

Base | $200T | $80T | $280T | $14.7M |

Optimistic | $400T | $100T+ | $500T+ | $26M+ |

Current (2025) | $2T | ~$0 | $2T | $105K |

Notes: AI demand projections based on machine economy growth models described in Section 6.5.2; these projections are inherently speculative. Effective supply assumed at 19 million BTC. All prices in real (inflation-adjusted) dollars.

Table 6.3a: Sensitivity Analysis—Terminal Valuations Under Varying Premium Assumptions

Scenario | SoV Premium -15% | Base Estimate | SoV Premium +15% |

Conservative Case | $4.3M | $5.6M | $7.0M |

Base Case | $11.2M | $14.7M | $18.4M |

Optimistic Case | $20.0M | $26.3M | $33.0M+ |

Notes: Sensitivity analysis shows how terminal valuations vary if store-of-value premium estimates differ by ±15% from base estimates. All figures in real dollars per BTC.

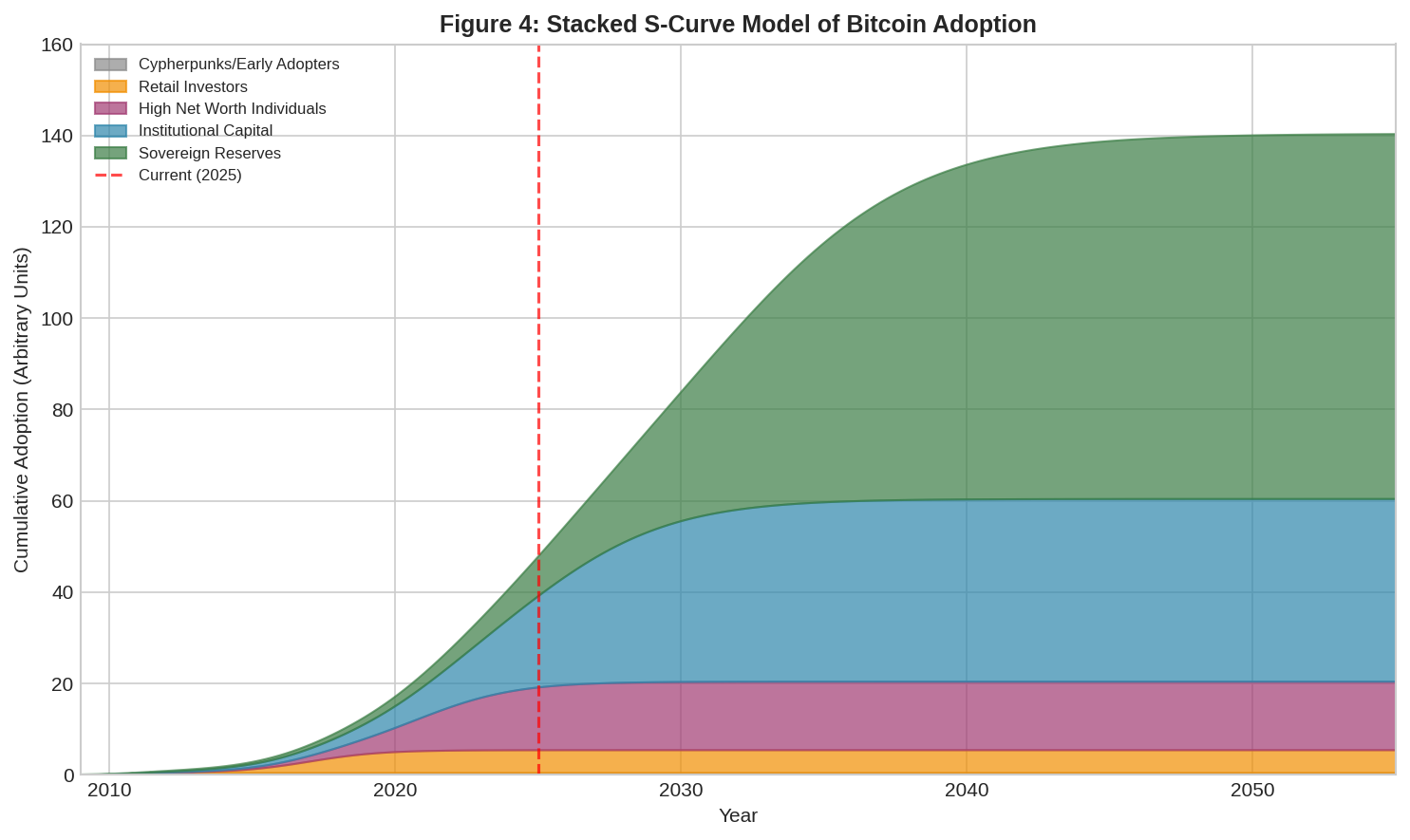

Adoption Dynamics: The Stacked S-Curve Model

Understanding how Bitcoin might achieve the market capitalizations described above requires modeling adoption dynamics. We employ a stacked S-curve framework that recognizes multiple overlapping adoption waves across different market segments and use cases.

Theoretical Foundation

Technology adoption typically follows a logistic (S-curve) pattern, as documented extensively in diffusion of innovation research [6.6, 6.7]. The S-curve reflects initial slow adoption among early adopters, accelerating growth as the mainstream market engages, and eventual saturation as addressable market is exhausted.

However, technologies with multiple use cases or market segments—what we term 'general-purpose technologies'—exhibit stacked S-curves: as one adoption curve saturates, the next begins, creating extended periods of exponential-like growth. The internet exemplifies this pattern, with sequential adoption waves in academia, enterprise, consumer, and mobile domains extending high growth over three decades.

Bitcoin's Adoption Waves

We identify six primary adoption waves for Bitcoin, each representing a distinct market segment with different motivations, risk tolerances, and capital pools:

Wave 1: Cypherpunks and Early Adopters (2009–2013). Initial adoption by cryptography enthusiasts, libertarians, and technologists. Market capitalization grew from zero to approximately $1 billion.

Wave 2: Retail Speculators and Investors (2013–2021). Broader public awareness drives retail investment. Market capitalization reached approximately $1 trillion at 2021 peak.

Wave 3: High Net Worth Individuals and Family Offices (2020–2030). Wealthy individuals allocate portions of portfolios to Bitcoin as alternative asset. Potential capital pool: $5–15 trillion.

Wave 4: Institutional Capital (2024–2040). Pension funds, endowments, insurance companies, and asset managers establish Bitcoin positions. The approval of spot Bitcoin ETFs in January 2024 represents a critical enabler [6.15]. Potential capital pool: $50–100 trillion.

Wave 5: Sovereign Reserves (2025–2055). Central banks and sovereign wealth funds adopt Bitcoin as reserve asset. El Salvador's September 2021 adoption of Bitcoin as legal tender represents early precedent [6.16]. Potential capital pool: $20–50 trillion in current reserves.

Wave 6: Machine Economies (2025–2050). Autonomous AI agents adopt Bitcoin as their native monetary medium for machine-to-machine transactions, resource allocation, and value storage [6.11]. This represents an entirely new category of demand with no historical precedent. Potential capital pool: $50–150 trillion as AI economic activity scales.

Power-Law Implications and Scale Invariance

An important consequence of stacked S-curves is that aggregate growth may approximate a power law over extended periods. When plotted on log-log scales, Bitcoin's price history shows remarkably linear behavior—a hallmark of power-law dynamics. This pattern emerges because as each S-curve saturates, the next begins, maintaining growth momentum.

Giovannetti (2023) and other researchers have documented Bitcoin's power-law behavior, noting its unusual consistency compared to other assets [6.10]. Scale invariance—the tendency for growth patterns to repeat across different time scales—suggests underlying adoption dynamics that transcend any single market cycle.

The ZeroPoint thesis provides theoretical grounding for this empirical observation. If Bitcoin represents the thermodynamic optimum for value storage, capital should flow toward it with mathematical regularity—the financial equivalent of entropy increasing in a physical system. The power-law trajectory reflects not speculative mania but the gradual recognition of monetary ground state.

If power-law dynamics continue, price projections can be bounded probabilistically. Historical analysis suggests that prices tend to revert toward the power-law trend line, with deviations offering asymmetric entry points for long-term investors.

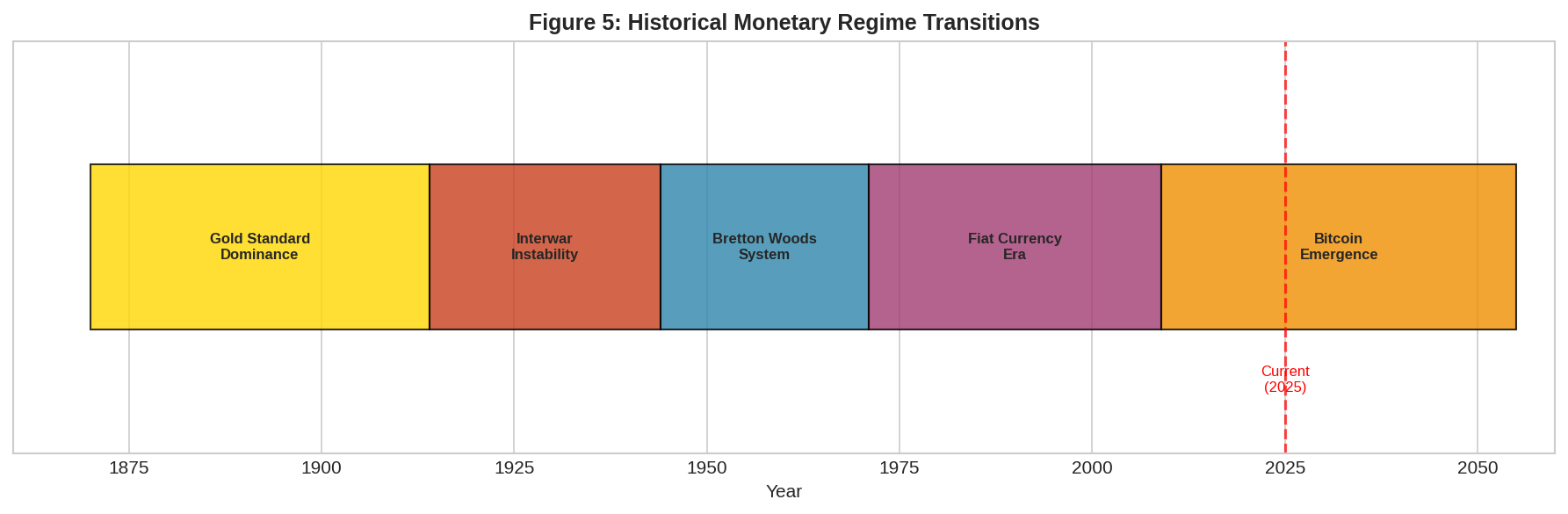

Historical Precedents: Monetary Regime Transitions

Understanding the timeline for potential Bitcoin adoption benefits from examination of historical monetary transitions. While history never repeats exactly, patterns in prior regime changes offer guidance on likely timeframes and dynamics.

The Gold Standard Era and Its Demise

The classical gold standard operated from approximately 1870 to 1914, with major economies linking their currencies to fixed gold quantities. The system provided monetary stability and facilitated international trade but proved insufficiently flexible for wartime finance. World War I effectively ended the classical gold standard, though attempts at restoration continued through the interwar period.

The transition from gold-backed money to fiat currency unfolded over approximately 60 years, from the Federal Reserve's establishment in 1913 through the final severance of the dollar-gold link in 1971. Key milestones included the 1933 domestic gold confiscation, the 1944 Bretton Woods agreement, and the 1971 Nixon Shock.

Reserve Currency Transitions

The transition from British pound sterling to U.S. dollar as primary reserve currency similarly required approximately 50 years, from the pound's peak dominance around 1914 to clear dollar hegemony by the 1960s. The transition was neither linear nor immediate; the pound retained significant reserve status well into the postwar period despite Britain's diminished economic position.

These precedents suggest that full monetary transitions typically require generational timeframes—on the order of 40–60 years. Bitcoin, however, possesses characteristics that may accelerate adoption: instant global accessibility, zero marginal cost of custody and transfer, and compatibility with existing financial infrastructure through ETFs and similar instruments.

The AI Acceleration Factor

A critical difference between historical monetary transitions and the potential Bitcoin transition is the role of artificial intelligence as an accelerant [6.11, 6.13]. AI systems analyzing monetary properties would rationally converge on Bitcoin as the optimal store of value—not through sentiment or tradition, but through mathematical optimization. As AI-driven analysis exposes fiat monetary instabilities with increasing precision, capital flight from weaker currencies could accelerate, potentially compressing transition timelines significantly.

Furthermore, AI systems require no generational attitude shift. They will adopt whatever monetary system best serves their operational requirements. If Bitcoin's properties prove superior for machine economic participation—permissionless access, programmable transactions, cryptographic security—AI adoption could proceed rapidly once the technology matures, potentially triggering cascading human adoption.

Timeline Projections

Based on historical precedents, adoption dynamics, and AI acceleration factors, we project that a full Bitcoin monetary transition—if it occurs—would likely complete between 2040 and 2055. This timeframe allows for institutional adoption curves to mature, regulatory frameworks to stabilize, and machine economies to scale.

The Base Case scenario assumes approximately 25–30 years from current date (2025) to terminal valuation, with most capital reallocation occurring in the 2030–2045 period. This aligns with expected timing for institutional, sovereign, and machine economy adoption waves.

Table 6.4: Projected Bitcoin Market Capitalization by Period

Period | Primary Adoption Wave | Conservative | Base | Optimistic |

2025 | Institutional (Early) | $2T | $2T | $2T |

2030 | Institutional + AI (Early) | $20T | $35T | $55T |

2035 | Sovereign + AI (Growth) | $50T | $100T | $180T |

2040 | Machine Economies (Peak) | $75T | $180T | $350T |

2045 | Maturation | $95T | $250T | $450T |

2050 | Terminal | $107T | $280T | $500T+ |

Notes: Projections include both human capital flows and AI-driven demand. Market cap figures represent total Bitcoin network value in real dollars.

Implications and Conclusion

Implications for Asset Prices

If the store-of-value transition materializes, significant implications follow for traditional asset classes. Real estate in major markets may experience substantial repricing as monetary premium dissipates, potentially improving housing affordability for those seeking shelter utility. Equity valuations may compress toward historical fundamental-driven ranges. Government bond yields may rise as store-of-value demand decreases, with implications for sovereign borrowing costs.

Importantly, this repricing need not represent economic contraction. Use values remain intact—homes still provide shelter, companies still generate profits, bonds still pay interest. What changes is that assets no longer carry inflated valuations from serving as substitutes for sound money. In this sense, Bitcoin's rise represents economic clarification rather than destruction.

The ZeroPoint Equilibrium

The ZeroPoint thesis suggests that Bitcoin's emergence is not merely one possible future among many but represents the discovery of a stable equilibrium toward which monetary systems will naturally tend. Just as physical systems evolve toward states of minimum energy, monetary systems under competitive pressure should evolve toward states of minimum entropy—maximum efficiency in storing and transmitting value across time.

This framing transforms the valuation question from 'How high can Bitcoin go?' to 'What is the equilibrium value of money that achieves zero monetary entropy?' The answer depends on the total store-of-value demand in the global economy—a figure we have estimated at approximately $400 trillion, with additional demand from machine economies potentially doubling this figure over coming decades.

Limitations and Caveats

We acknowledge several limitations in this analysis. Store-of-value premium estimates involve substantial uncertainty; reasonable analysts might differ significantly on the portion of real estate or equity values attributable to monetary premium. AI demand projections are necessarily speculative, depending on the pace of AI capability development, regulatory frameworks, and competitive dynamics among monetary systems.

The assumption that Bitcoin can capture these premiums presupposes regulatory tolerance, technical reliability, and competitive success against alternative digital assets and central bank digital currencies. The timeline projections assume continued network operation, security, and development—assumptions that have held for 15 years but remain subject to technological and governance risks.

Additional risk factors warrant consideration:

Regulatory risk: Governments may impose restrictions, bans, or punitive taxation on Bitcoin holdings and transactions, particularly during periods of capital flight or monetary crisis.

Technical risk: While Bitcoin's cryptographic foundations are considered secure, theoretical vulnerabilities exist, including the potential for quantum computing advances to compromise current encryption standards.

Competition risk: Central bank digital currencies (CBDCs) and alternative cryptocurrencies may capture portions of the store-of-value market that this analysis attributes to Bitcoin.

Behavioral barriers: Volatility perception, complexity of self-custody, and general unfamiliarity may slow adoption beyond what network effects analysis would suggest.

Conclusion

This chapter has presented a comprehensive framework for Bitcoin valuation based on store-of-value premium capture and machine economy demand. Our analysis suggests that terminal valuations in the range of $5–26 million per BTC (real dollars) are arithmetically consistent with reasonable assumptions about global wealth composition, store-of-value premiums, market share capture, and AI-driven demand.

The path to such valuations requires multiple adoption waves unfolding over generational timeframes—consistent with historical precedents for monetary transitions but potentially accelerated by AI capabilities. The stacked S-curve model [6.6, 6.7] provides a framework for understanding adoption dynamics, while power-law behavior suggests underlying scale invariance that may persist through multiple market cycles.

Ultimately, Bitcoin's success depends on its fundamental value proposition: absolute scarcity, digital portability, and censorship resistance in an era of unprecedented monetary expansion and artificial intelligence proliferation [6.8]. The ZeroPoint thesis suggests these properties are not merely desirable but essential—that Bitcoin represents the only monetary system capable of functioning as both the store of value for human wealth and the native currency of machine economies.

The decision facing investors and policymakers is not whether to engage with this analysis but whether to position ahead of a potential transition that, if it occurs, will represent one of the most significant capital reallocations in economic history. In the age of artificial intelligence, the discovery of monetary ground state may prove as consequential as the discovery of zero in mathematics—a foundation upon which entirely new structures become possible.

References

[6.1] Jevons, W. S. (1875). Money and the Mechanism of Exchange. Appleton & Company.

[6.2] Menger, C. (1892). On the origin of money. Economic Journal, 2(6), 239-255.

[6.3] Ammous, S. (2018). The Bitcoin Standard: The Decentralized Alternative to Central Banking. Wiley.

[6.4] Credit Suisse Research Institute. (2024). Global Wealth Report 2024. Credit Suisse Group AG.

[6.5] McKinsey Global Institute. (2021). The rise and rise of the global balance sheet: How productively are we using our wealth? McKinsey & Company.

[6.6] Rogers, E. M. (1962). Diffusion of Innovations. Free Press.

[6.7] Bass, F. M. (1969). A new product growth model for consumer durables. Management Science, 15(5), 215-227.

[6.8] Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. White Paper.

[6.9] Szabo, N. (2002). Shelling Out: The Origins of Money. Satoshi Nakamoto Institute.

[6.10] Giovannetti, G. (2023). Bitcoin's power law: A quantitative analysis of Bitcoin's long-term price dynamics. Working Paper.

[6.11] See Chapter 8: AI as an Economic Actor. This chapter develops the framework for understanding AI agents as autonomous economic participants requiring permissionless monetary infrastructure.

[6.12] World Gold Council. (2024). Gold Demand Trends Q4 2024. World Gold Council.

[6.13] Aschenbrenner, L. (2024). Situational Awareness: The Decade Ahead. Situational Awareness Papers.

[6.14] Chainalysis. (2023). The State of Lost Bitcoin: Methodology and Estimates. Chainalysis Research.

[6.15] U.S. Securities and Exchange Commission. (2024). Spot Bitcoin ETP Approvals. SEC Press Release, January 10, 2024.

[6.16] Government of El Salvador. (2021). Bitcoin Law (Ley Bitcoin). Legislative Decree No. 57, June 8, 2021.

— END OF CHAPTER 6 —

Page

Coming Soon

This chapter will be available soon.